Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Best Travel Credit Cards of January 2026

July 1, 2025

This article is brought to you in partnership with The Points Guy.

Advertiser Disclosure: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

When it comes to racking up credit card rewards, the key is to play it smart. Think about it: if you’re using just one card for everything, you’re probably missing out on some serious rewards. The trick is to have a few different cards, each one geared for different spending categories. But let’s be real, the world of credit cards can be confusing, and finding the right ones can be overwhelming. That’s why our guide is a game changer. We spotlight the best of the best cards for major spending categories. You won’t just earn more points or cash back; you’ll also get your hands on some awesome benefits that come with these cards. So, let's make your expenses work for you!

In this edition, here's our rundown of the Best Travel Cards of January 2025, broken down by:

- Personal Travel Cards

- Business Travel Cards

Best Personal Travel Cards

Best for beginner travelers: Chase Sapphire Preferred® Card

[[ SINGLE_CARD * {"id": "509", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Exceptional Travel Value"} ]]

Best for non-bonus spending: Capital One Venture Rewards Credit Card

.png)

[[ SINGLE_CARD * {"id": "438", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "High Travel Rewards" } ]]

Best for dining at restaurants: American Express® Gold Card

[[ SINGLE_CARD * {"id": "118", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Generous Travel Rewards"} ]]

Best for luxury benefits: American Express Platinum Card®

.png)

[[ SINGLE_CARD * {"id": "106", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Serious Points on Flights"} ]]

Best for premium travel: Capital One Venture X Rewards Credit Card

[[ SINGLE_CARD * {"id": "2888", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "Luxurious Travel Benefits" } ]]

Best for starter travelers: Citi Premier® Card

[[ SINGLE_CARD * {"id": "570", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Everyday Spenders", "headerHint" : "Generous Rewards" } ]]

Best for travel rewards with no annual fee: Capital One VentureOne Rewards Credit Card

[[ SINGLE_CARD * {"id": "440", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Most Premium Delta Offer"} ]]

Best for travel credits: Chase Sapphire Reserve®

.png)

[[ SINGLE_CARD * {"id": "510", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "$300 Annual Travel Credit"} ]]

Best for American Airlines Loyalists: Citi® / AAdvantage® Executive World Elite Mastercard®

[[ SINGLE_CARD * {"id": "544", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "No Transaction Fees" } ]]

Best for Casual Delta Flyers: Delta SkyMiles® Gold American Express Card

[[ SINGLE_CARD * {"id": "1010", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "Popular Choice" } ]]

Best for Delta Loyalists on the Status Fast Track: Delta SkyMiles® Reserve American Express Card

[[ SINGLE_CARD * {"id": "781", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Most Premium Delta Offer"} ]]

First Class Travel for Southwest Loyalists: Southwest Rapid Rewards® Priority Credit Card

[[ SINGLE_CARD * {"id": "2162", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Southwest Loyalists", "headerHint" : "Generous Benefits and Perks" } ]]

Best Business Travel Cards

Best for freelancers: Ink Business Unlimited® Credit Card

[[ SINGLE_CARD * {"id": "1098", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Small Business Owners", "headerHint" : "No Fee Card" } ]]

Best for bonus earning: Ink Business Preferred® Credit Card

[[ SINGLE_CARD * {"id": "1100", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Business Owners", "headerHint" : "Valuable Rewards" } ]]

Best for high-spending businesses: Capital One Venture X Business

[[ SINGLE_CARD * {"id": "3444", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Business Owners", "headerHint" : "Top Business Travel Card" } ]]

Best for business travel luxury: The Business Platinum Card® from American Express

.png)

[[ SINGLE_CARD * {"id": "2290", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Business Owners", "headerHint" : "Premium Offer" } ]]

Best Personal Travel Cards

Best for beginner travelers: Chase Sapphire Preferred® Card

[[ SINGLE_CARD * {"id": "509", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Exceptional Travel Value"} ]]

Best for non-bonus spending: Capital One Venture Rewards Credit Card

.png)

[[ SINGLE_CARD * {"id": "438", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "High Travel Rewards" } ]]

Best for dining at restaurants: American Express® Gold Card

[[ SINGLE_CARD * {"id": "118", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Generous Travel Rewards"} ]]

Best for luxury benefits: American Express Platinum Card®

[[ SINGLE_CARD * {"id": "106", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Serious Points on Flights"} ]]

Best for premium travel: Capital One Venture X Rewards Credit Card

[[ SINGLE_CARD * {"id": "2888", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "Luxurious Travel Benefits" } ]]

Best for starter travelers: Citi Premier® Card

[[ SINGLE_CARD * {"id": "570", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Everyday Spenders", "headerHint" : "Generous Rewards" } ]]

Best for travel rewards with no annual fee: Capital One VentureOne Rewards Credit Card

[[ SINGLE_CARD * {"id": "440", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Most Premium Delta Offer"} ]]

Best for travel credits: Chase Sapphire Reserve®

.png)

[[ SINGLE_CARD * {"id": "510", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "$300 Annual Travel Credit"} ]]

Best for American Airlines Loyalists: Citi® / AAdvantage® Executive World Elite Mastercard®

[[ SINGLE_CARD * {"id": "544", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "No Transaction Fees" } ]]

Best for Casual Delta Flyers: Delta SkyMiles® Gold American Express Card

[[ SINGLE_CARD * {"id": "1010", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "Popular Choice" } ]]

Best for Delta Loyalists on the Status Fast Track: Delta SkyMiles® Reserve American Express Card

[[ SINGLE_CARD * {"id": "781", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Most Premium Delta Offer"} ]]

First Class Travel for Southwest Loyalists: Southwest Rapid Rewards® Priority Credit Card

[[ SINGLE_CARD * {"id": "2162", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Southwest Loyalists", "headerHint" : "Generous Benefits and Perks" } ]]

Best for business versatility and travel rewards: American Express® Business Gold Card

[[ SINGLE_CARD * {"id": "111", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Business Owners", "headerHint" : "Versatile Business Tool" } ]]

Best for Southwest Business Travelers: Southwest Rapid Rewards® Premier Business Credit Card

[[ SINGLE_CARD * {"id": "2160", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Business Owners", "headerHint" : "Large Welcome Offer" } ]]

Best for Small Business Owners who fly United: The New UnitedSM Business Card

.png)

[[ SINGLE_CARD * {"id": "2403", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Business Owners", "headerHint" : "Strong Card Contender" } ]]

Interested in seeing our picks for best cashback cards? Make sure to visit our Best Cashback Credit Cards post. Also, don't forget to check out our Best Airline Cards and Business Cards!

Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

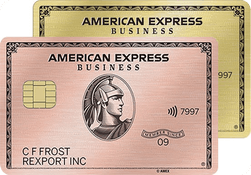

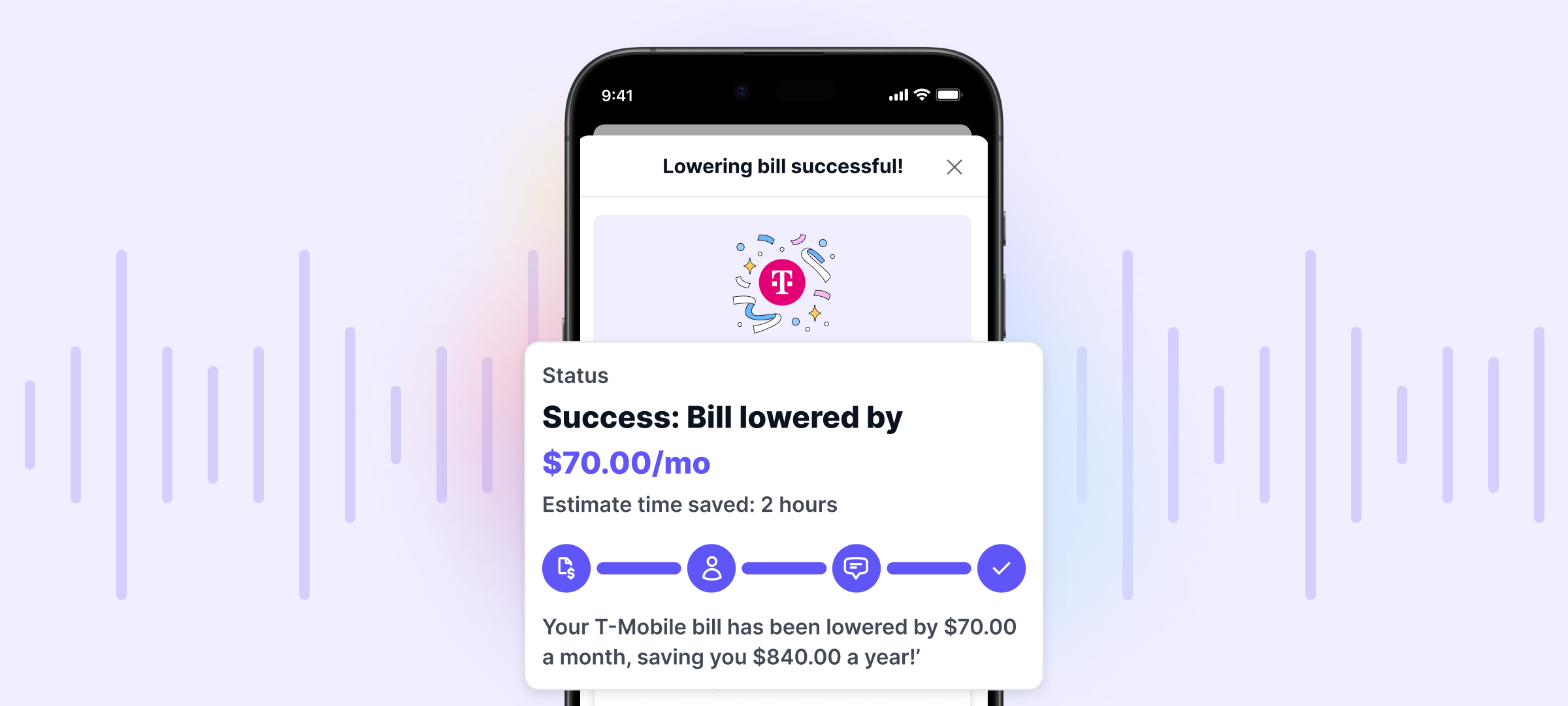

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)