Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Your Guide to Picking the Best Southwest Credit Card for 2026

July 1, 2025

Introduction to the Southwest Credit Cards

Southwest Airlines, known for its customer-friendly policies and extensive domestic (and now international) network, offers a range of co-branded credit cards that can help you earn valuable Southwest Rapid Rewards points and unlock exclusive perks. In this article, we'll help you decide if you should add one of these cards to your wallet.

What are the Southwest Personal Credit Cards?

Southwest Airlines partners with Chase and Visa to offer three personal credit cards and two business credit cards. We're going to focus on the personal offerings that come in three different flavors:

[[ CARD_LIST * {"ids": ["2159", "2161", "2162"]} ]]

For the Casual Southwest Traveler

[[ SINGLE_CARD * {"id": "2159", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Affordable Travel Rewards", "headerHint" : "Southwest Savings" } ]]

If you're even only an occasional Southwest Airlines flyer looking for a way to boost your Rapid Rewards points and enjoy travel perks, the Southwest Rapid Rewards® Plus Credit Card is definitely worth considering. It's ideal for occasional travelers who love Southwest's service but don't fly frequently enough to justify a higher annual fee. This card offers a taste of Southwest perks without breaking the bank, making it perfect for those who want to dip their toes into the Rapid Rewards program and enjoy some benefits without a hefty price tag.

The points you earn with the Southwest Rapid Rewards® Plus Credit Card can be redeemed for flights, hotel stays, car rentals, gift cards, and more. Southwest Airlines is known for its customer-friendly policies, including no change fees and two free checked bags per passenger, which can save you hundreds of dollars on your travels.

One potential drawback of this card is that it doesn't offer some of the premium travel benefits you will find on higher-end cards like the Chase Sapphire Reserve® and Capital One Venture X Rewards Credit Card. Those include airport lounge access, as well as travel credits and protections. However, for a reasonable annual fee, the Southwest Rapid Rewards® Plus Credit Card still provides excellent value for even occasional Southwest flyers.

[[ SINGLE_CARD * {"id": "510", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "$300 Annual Travel Credit"} ]]

[[ SINGLE_CARD * {"id": "2888", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "Luxurious Travel Benefits" } ]]

You can get more value from these cards in the first year with the welcome bonus. This bonus alone can be enough for two round-trip flights, depending on your destination and travel dates.

For the Regular Southwest Traveler

[[ SINGLE_CARD * {"id": "2161", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Unlock Rewards for Free Flights", "headerHint" : "Offer Ending Soon" } ]]

If you fly Southwest Airlines regularly and are looking for a credit card that offers a bit more than the basics, the Southwest Rapid Rewards® Premier Credit Card fits the bill is the best option for Southwest loyalists, with an annual travel credit and an opportunity to earn tier-qualifying points.

For the Southwest Loyalist

[[ SINGLE_CARD * {"id": "2162", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Premium Amenities", "headerHint" : "Offer Ending Soon" } ]]

The Southwest Rapid Rewards® Priority Credit Card rounds out the last of Southwest's personal card cards as the highest tier offering. This card offers a host of benefits that can make your journeys more comfortable, rewarding, and cost-effective.

Another standout feature is the four upgraded boardings per year (when available). This allows you to secure a coveted A1-A15 boarding position, ensuring you travel in your preferred seat.

How To Redeem Southwest Rapid Rewards

You can redeem Rapid Rewards points in a number of ways. You’ll get the most value from points when you use them to book flights with Southwest Airlines.

You can also redeem your points to:

- Book hotel stays at more than 400,000 Rapid Rewards partner properties

- Book car rentals

- Pay for experiences such as spa packages, rafting and hiking

- Get gift cards or merchandise

Southwest Rapid Rewards Credit Card Score Requirements

To qualify for a Southwest credit card, you generally need a good to excellent credit score (670 or higher). Keep in mind that Chase also has a 5/24 rule, which means you may not be approved if you've opened five or more credit cards in the past 24 months.

Before you apply, there are a couple of other important rules to keep in mind:

- You can only hold one personal Southwest credit card at a time. No double-dipping allowed!

- If you've snagged a welcome bonus from any Southwest personal card in the last 24 months, you'll need to wait a bit longer.

Is a Southwest Rapid Rewards Credit Card Worth It?

Ultimately, the value of a Southwest credit card depends on your travel habits and goals. For many, the benefits far outweigh the costs, making these cards a worthwhile investment. Consider your travel patterns, crunch the numbers, and you might find that a Southwest Rapid Rewards credit card is your ticket to more rewarding adventures.

Alternatives to the Southwest Rapid Rewards Credit Cards

If you’re looking for more flexible rewards, consider the Chase Sapphire Preferred® Card. While the Southwest cards offer good rewards for Southwest enthusiasts, they may not be the best choice if you want more flexibility in your rewards. These alternatives provide broader rewards options and travel benefits.

Chase Sapphire Preferred® Card

- [[ SINGLE_CARD * {"id": "509", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Exploring the World", "headerHint" : "Travel Rewards" } ]]

Capital One Venture Rewards Credit Card

- [[ SINGLE_CARD * {"id": "438", "isExpanded": "false", "bestForCategoryId": "22", "bestForText": "Straightforward Travel Rewards", "headerHint" : "Clear Cut Earning" } ]]

Our Expert Takeaway

These three Southwest credit cards offer compelling value for frequent Southwest flyers. The generous sign-up bonus, anniversary points, and accelerated earning on Southwest purchases can quickly offset the annual fees. The cards' ability to earn towards earning the coveted Companion Pass is a standout feature, potentially saving travelers thousands on flights. However, the cards' value diminishes for those who don't regularly fly Southwest or prefer more flexible rewards programs. For Southwest loyalists, these cards can significantly enhance travel experiences and provide substantial savings, making them a worthy addition to their wallets.

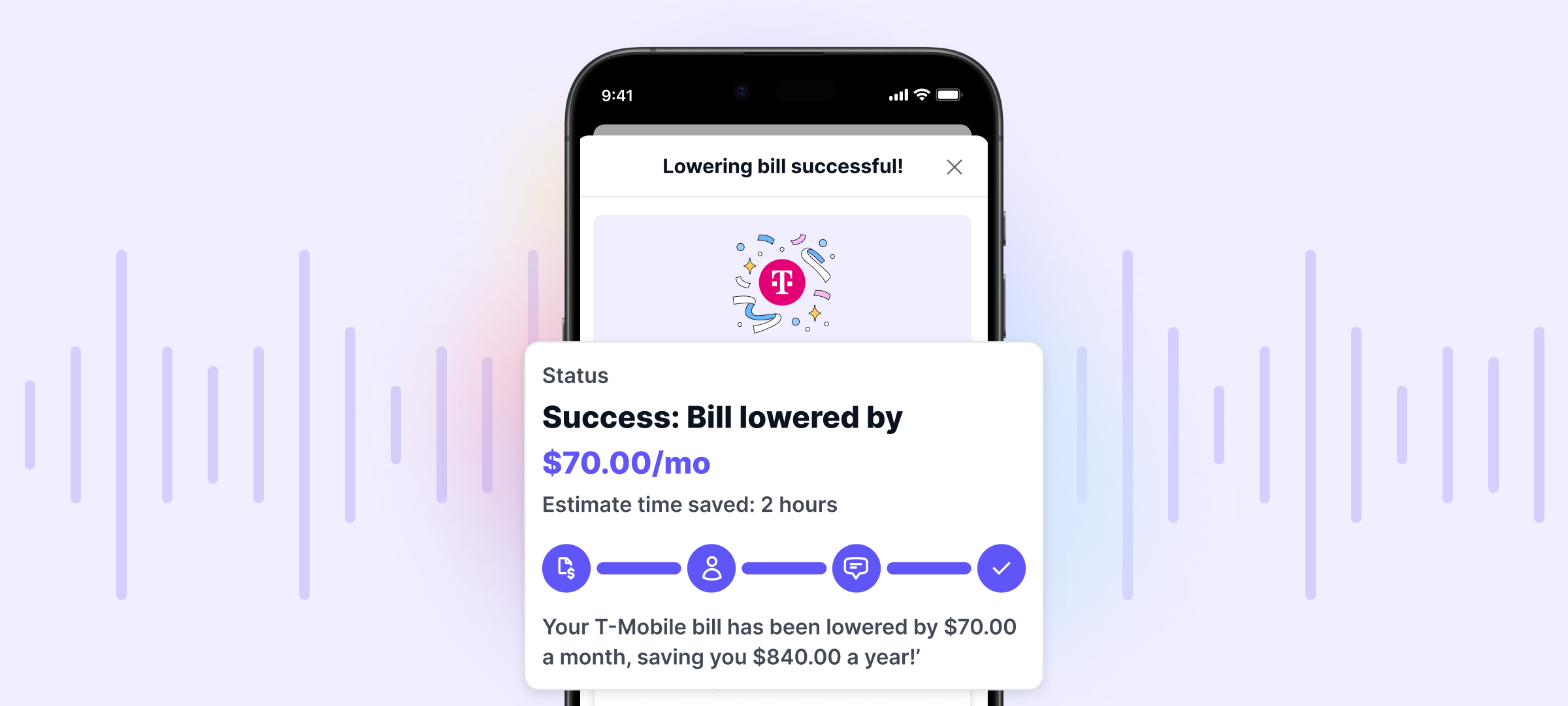

Additionally, you can enhance your rewards even further by using Kudos. Kudos is a free, AI-powered smart wallet that helps you maximize your credit card rewards. It recommends the best card to use for each purchase, ensuring you get the most out of your Ulta Credit Card and other cards in your wallet. Start using Kudos today to turn your everyday spending into significant rewards!

Southwest Rapid Rewards Credit Cards FAQs

How do I check my points balance?

Just log into your Southwest account to check your points balance.

What is the Southwest Companion Pass and how do I get it?

The Southwest Companion Pass allows you to bring a partner, friend, or family member on any flight for just the taxes and fees, which are only $5.60 per person for one-way flights within the U.S. This benefit applies whether you pay for your ticket with cash or points and is valid for both domestic and international flights with Southwest. You can use the pass as many times as you like during its validity period. Additionally, you can change your designated companion up to three times per calendar year, so you don’t have to bring the same person each time. The main restriction is that your companion cannot fly without you.

Southwest requires you to either fly 100 qualifying flight segments or earn 135,000 qualifying Rapid Rewards points in a calendar year to earn it. Luckily, the points you earn from signing up for one of the three personal Southwest cards gets counted toward the qualification requirement. In this case, with 40,000 points, you're almost a third of the way there!

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)