Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Is Bilt Cash Worth It? What the January 2026 Changes Mean for Your Rent Rewards

July 1, 2025

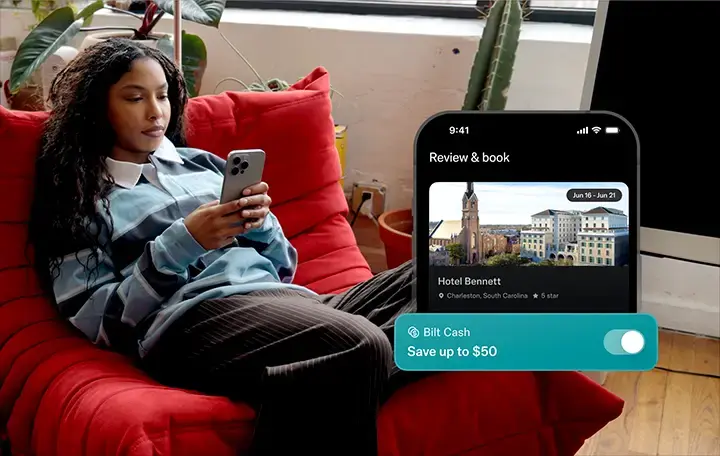

Starting January 1, 2026, Bilt Rewards will replace its underwhelming Milestone Rewards program with something actually useful: Bilt Cash, a new currency that works like real money at participating merchants. If you're already earning Bilt Points on rent, you'll automatically start earning $50 in Bilt Cash for every 25,000 points. This adds real spending power at over 40,000 merchants, making the Bilt Mastercard® (See Rates & Fees) even more valuable for renters.

The Bilt Mastercard® is no longer available for new applicants. Information collected independently by Kudos.

What Is Bilt Cash and How Does It Work?

Bilt Cash is straightforward: $1 in Bilt Cash = $1 in spending power at Bilt's network of merchants. Every 25,000 Bilt Points = $50 in Bilt Cash (automatically added to your account). That's a 0.2% return on your point earnings, paid out in cash you can actually use.

Where You Can Spend Bilt Cash:

- Restaurants using mobile checkout

- Hotels through Bilt's travel portal

- Fitness classes

You can also use Bilt Cash to unlock one-time elite status perks, like accessing Gold member transfer bonuses if you're currently Silver.

The Math: How Much Bilt Cash Will You Earn?

Let's break down realistic scenarios based on how you'd actually use the card.

Scenario 1: Rent-Only Strategy

- Monthly rent: $2,000

- Annual rent: $24,000

- Bilt Points earned: 24,000 (up to 100,000 points in a calendar year on rent)

- Bilt Cash earned: $48/year

Note: You must use the card 5 times each statement period to earn points on your rent.

Scenario 2: Rent + Strategic Spending

- Annual rent: $24,000 → 24,000 points

- $500/month on Rent Day (2x points, excluding rent, up to 1,000 bonus points) → 12,000 points

- $300/month regular spending → 3,600 points

- Total: 39,600 Bilt Points = $79 in Bilt Cash

Scenario 3: Power User

- Annual rent: $60,000 (capped at 100,000 points in a calendar year)

- Maxing Rent Day bonuses → 12,000 points

- Strategic dining/travel → 13,000 points

- Total: 125,000 Bilt Points = $250 in Bilt Cash

The sweet spot? You'll hit that first $50 in Bilt Cash faster than you think if you're already paying rent with the card.

How Bilt Cash Compares to Milestone Rewards

Let's be honest: Milestone Rewards were forgettable.

What You Got Before (Milestone Rewards):

- Vague bonus points for specific actions

- Unclear qualifying criteria

- Maybe 1,000 extra points if you jumped through hoops

- Felt more like a marketing gimmick than real value

What You Get Now (Bilt Cash):

- Clear earning rate: Every 25,000 points = $50 cash

- Instant availability: Bilt Cash is usable immediately when you hit the milestone

- Real purchasing power: $1 = $1 at merchants

- No expiration date confusion: Use it when you want

The upgrade is significant. Bilt Cash actually incentivizes you to stay engaged with the ecosystem instead of just earning points and transferring them out immediately.

Who Should Care About Bilt Cash?

You'll benefit most if you:

- Pay rent with the Bilt Mastercard® (See Rates & Fees) and earn 24,000+ points annually

- Live in a major city with dense Bilt merchant networks (NYC, Chicago, Miami, LA, SF)

- Regularly dine out at restaurants that accept mobile checkout

- Already use Bilt's fitness or home delivery partners

- Want a guaranteed 0.2% return on points without transfer partner complexity

You can skip Bilt Cash if you:

- Maximize every point for airline/hotel transfers (stick with that strategy)

- Live in a smaller market with limited Bilt partners

- Rarely spend at Bilt network merchants

- Prefer simplicity and don't want to track another currency

Should You Apply for the Bilt Mastercard Now?

Yes, if you:

- Currently pay rent and aren't earning rewards on it

- Want to earn Bilt Points that transfer to 17+ airline and hotel partners

- Can commit to making 5 purchases per statement period

- Value both flexibility (points) and guaranteed value (Bilt Cash)

- Have good credit (typically 670+ FICO score recommended)

Wait or reconsider if you:

- Own your home (you won't earn rent points, the card's primary value)

- Can't make 5 transactions monthly (you won't earn points at all)

- Your landlord doesn't accept the payment methods Bilt requires

- You prefer cards with higher everyday earning rates

Remember: You must use the card 5 times each statement period to earn points on all purchases, including rent.

Bilt Cash vs. Other Credit Card Ecosystems

Bilt isn't the first company to create a closed-loop rewards currency. Here's how it stacks up:

The key difference? Bilt Cash is earned automatically on top of your regular Bilt Points. You’re not choosing between one or the other.

How to Maximize Both Bilt Points and Bilt Cash

Smart strategy: Use both currencies for different purposes.

Bilt Points Strategy:

- Save for high-value airline transfers (target 1.5-2¢+ per point)

- Book hotel stays through transfer partners

- Redeem for statement credits in a pinch

Bilt Cash Strategy:

- Use for everyday dining and services (guaranteed $1 = $1)

- Buy one-time status upgrades during valuable promotions

- Offset costs for fitness classes or home delivery

Example monthly plan:

- Pay $2,000 rent → 2,000 Bilt Points

- Make 5 purchases to unlock rent points

- Use Rent Day 2x earning for $500 in purchases → 1,000 points

- Build toward 25,000 points = $50 Bilt Cash milestone

- Use Bilt Cash for $50 off dining that month

- Transfer remaining Bilt Points to Hyatt for hotel stays

This approach gives you both flexibility (points) and guaranteed value (cash).

What Happens to Your Current Milestone Rewards?

If you've already claimed Milestone Rewards:

- They remain valid until expiration

- You can still earn maximum points for that reward

- Nothing changes for you before January 1, 2026

Starting January 1, 2026:

- No new Milestone Rewards can be claimed

- All new milestones pay out in Bilt Cash instead

- Unused 2025 Milestone Rewards expire December 31, 2025

Action item: If you're close to a Milestone Reward in December 2025, complete it before year-end. After that, you'll start fresh with Bilt Cash.

The Bilt Transfer Partner List (Updated)

When you earn Bilt Points (which then generate Bilt Cash), you can still transfer those points to these partners:

Airlines (1:1 transfers):

- Alaska Airlines

- United MileagePlus®

- Air France/KLM Flying Blue®

- British Airways Executive Club

- Cathay Pacific

- Turkish Airlines Miles&Smiles

- Aer Lingus AerClub

- Iberia Plus

- Air Canada Aeroplan®

- Southwest Airlines

- Japan Airlines

- Emirates Skywards®

- Virgin Atlantic Flying Club

- Qatar Airways Privilege Club Avios

- Virgin Red®

- Avianca Lifemiles

- TAP Miles&Go

Hotels:

- Hilton Honors (1:1)

- Marriott Bonvoy™ (1:1)

- World of Hyatt® (1:1)

- IHG® One Rewards (1:1)

- Accor Live Limitless (3:2)

This means you're not sacrificing transfer flexibility by earning Bilt Cash. You get both.

Common Questions About Bilt Cash

Does earning Bilt Cash reduce my Bilt Points?

No. Bilt Cash is earned in addition to your regular Bilt Points. You keep all your points and get Bilt Cash as a bonus.

Can I convert Bilt Points to Bilt Cash?

Not currently. Bilt Cash is only earned through the automatic milestone system (every 25,000 points).

Does Bilt Cash expire?

Bilt hasn't announced an expiration policy yet. More details will be released before January 2026.

Can I transfer Bilt Cash to someone else?

No. Bilt Cash is tied to your account and can only be used by you.

Is Bilt Cash worth more than Bilt Points?

It depends on how you redeem. Bilt Points can be worth 1.5-2¢+ when transferred to airlines. Bilt Cash is always worth exactly $1 per $1. Guaranteed value, but no upside.

The Bottom Line: Is Bilt Cash Worth Your Attention?

Bilt Cash solves a real problem. It gives you tangible, guaranteed value inside Bilt's ecosystem, which continues to grow. For current Bilt cardholders, this is pure upside. You're already earning points. Now you'll get spendable cash on top of that. No action required. For prospective applicants: if you pay $1,500+ in monthly rent and live near Bilt's merchant network, you'll earn meaningful Bilt Cash annually while building transferable points.

Remember to use the card 5 times each statement period to earn points. Bilt Cash won't replace the value of strategic airline transfers, but it adds a nice baseline return for points you're earning anyway. The key insight? Bilt Cash makes the whole rewards program less intimidating. You don't need to master transfer partner sweet spots to get value: $1 = $1 is as simple as it gets.

Ready to start earning? Kudos automatically tracks which card gives you the best rewards for every purchase, including the Bilt Mastercard for your rent and everyday spending.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)

.webp)