Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

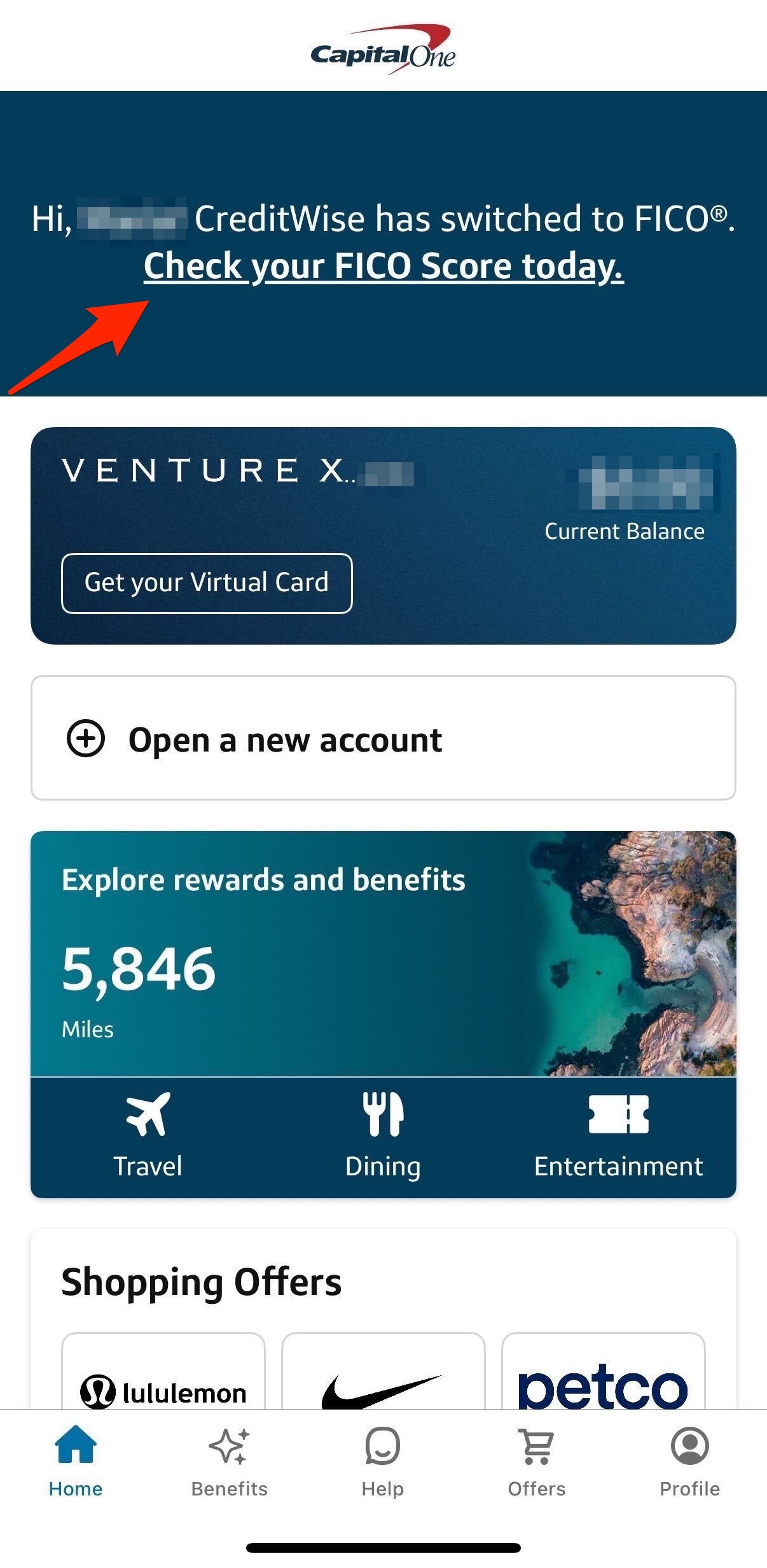

Capital One CreditWise Switches to FICO Scores: What You Need to Know in 2026

July 1, 2025

Capital One has officially announced that its CreditWise program is transitioning from VantageScore to FICO scoring by Summer 2025. This significant change means Capital One customers will now have free access to their TransUnion FICO 8 scores, making it one of the most valuable free credit monitoring services available.

What's Changing with Capital One CreditWise?

Capital One's CreditWise service previously provided customers with their VantageScore 3.0 from TransUnion. The free service now provides Capital One users with their FICO 8 scores from TransUnion instead.

Key Changes:

- Old Score: TransUnion VantageScore 3.0

- New Score: TransUnion FICO 8

- Timeline: Rolling out through Summer 2025 - check your account now, as it’s likely updated!

- Cost: Still completely free for Capital One customers

- Frequency: Daily updates (mainatined from previous service)

Why This Change Matters

FICO vs VantageScore: The Important Difference

FICO scores are used by approximately 90% of lenders for credit decisions, making them far more relevant than VantageScore for real-world lending scenarios. While VantageScore can give you a general idea of your credit health, FICO scores are what matter when you're applying for:

- Credit cards

- Auto loans

- Mortgages

- Personal loans

- Other forms of credit

Impact on Your Credit Score

Many users are reporting significant differences between their VantageScore and FICO scores. Some common patterns include:

- FICO scores are often higher than VantageScore for most consumers

- Differences of 50-100+ points are not uncommon

- Different weighting systems mean the scores calculate differently

Important: Your actual creditworthiness hasn't changed – you're just seeing a different (and more widely used) scoring model

How to Get Your FICO Score from Capital One Now

If you don't want to wait for the automatic rollout, there's a simple way to force the switch:

- Open the Capital One app or website

- Go to CreditWise settings

- Unenroll from CreditWise

- Wait a few minutes

- Re-enroll in CreditWise

- Your account should now display FICO 8 scores

This process takes less than 30 seconds and immediately switches your account to FICO scoring.

Free FICO Scores: Complete Guide to Credit Card Issuers

Capital One joining the FICO party is significant because free TransUnion FICO scores have been relatively rare. Here's your complete guide to getting free FICO scores from credit card issuers:

TransUnion FICO 8 (Newly Available)

- Capital One CreditWise - Daily updates (NEW!)

- Discover Credit Scorecard - Monthly updates (available to everyone, even non-customers)

- Bank of America - For customers only

- Barclays - For customers only

Experian FICO 8 (Most Common)

- Experian.com - Free with basic account

- American Express - Weekly updates for cardholders

- Wells Fargo - For customers

- Chase - Some products offer Experian FICO

- Citi - Select products

- US Bank - For customers

Equifax FICO 8

- MyFICO.com - Free Equifax FICO 8 monthly

- Citi - Some credit cards provide Equifax FICO scores

- Various credit unions - Check with your local credit union

Why TransUnion FICO 8 Matters

Getting free access to your TransUnion FICO 8 score is particularly valuable because:

- It's been the hardest FICO score to get for free - Most free options focus on Experian

- TransUnion data can differ significantly from the other bureaus

- Some lenders primarily use TransUnion for credit decisions

- Daily monitoring helps you track changes quickly

Best Strategy for Monitoring All Your FICO Scores

With Capital One's switch, here's the optimal free setup for monitoring all three FICO 8 scores:

Daily Monitoring

- TransUnion FICO 8: Capital One CreditWise

- Experian FICO 8: Experian.com or American Express

Monthly Monitoring

- Equifax FICO 8: MyFICO.com free tier

- TransUnion FICO 8: Discover Credit Scorecard (backup)

Credit Report Monitoring

- Kudos - Free Vantage Score 3.0 (we’re looking at updating our service to FICO too!)

- AnnualCreditReport.com - Free annual reports from all three bureau

Impact of the Capital One-Discover Merger

This change likely relates to Capital One's pending acquisition of Discover. Since Discover already provides FICO scores to customers, standardizing on FICO across both companies makes strategic sense.

What This Means:

- Unified scoring approach across the merged entity

- Better customer experience with more relevant scores

- Potential for enhanced credit monitoring features in the future

Tips for Understanding Your New FICO Score

Don't Panic About Score Differences

- Your credit hasn't actually changed - just the scoring model

- FICO is more accurate for lending decisions

- Use this as motivation to improve your actual credit profile

Focus on FICO Score Factors

FICO 8 weighs these factors differently than VantageScore:

- Payment History (35%) - Most important factor

- Credit Utilization (30%) - Keep below 10% for best scores

- Length of Credit History (15%) - Longer is better

- Credit Mix (10%) - Various account types help

- New Credit (10%) - Minimize recent inquiries

Frequently Asked Questions

When will my Capital One account switch to FICO?

The rollout is happening gradually through Summer 2025. You can force the switch early using the unenroll/re-enroll method described above.

Will my score be different?

Most likely, yes. FICO and VantageScore use different algorithms, so scores often differ by 50+ points.

Is this really free?

Yes, completely free for all Capital One customers, including those without credit cards (checking account customers get access too).

How often does it update?

Daily, just like the previous VantageScore service.

Bottom Line

Capital One's switch to FICO scoring is a major win for consumers. With free daily access to TransUnion FICO 8 scores, Capital One customers now have access to the credit scores that actually matter for lending decisions.

Combined with other free FICO score sources, you can now monitor all three bureaus' FICO scores without paying monthly fees to services like MyFICO's premium plans.

Action Steps:

- Force the switch using the unenroll/re-enroll method if you're impatient

- Set up monitoring across all three bureaus using the free options outlined above

- Focus on improving your actual credit factors rather than worrying about score differences

- Use your new FICO awareness to make better credit decisions

This change represents Capital One's commitment to providing customers with the most relevant and useful credit information and it’s completely free!

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)