Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Best Military Credit Cards 2026: Chase Sapphire Reserve + Complete Fee Waiver Guide

July 1, 2025

Imagine accessing a $550 annual fee credit card—completely free. No catches, no asterisks. Just premium travel perks, statement credits worth hundreds, and elite status at hotels worldwide.

For active duty military members and their spouses, this isn't a fantasy. It's a benefit you've earned.

Thanks to two federal laws—the Military Lending Act (MLA) and Servicemembers Civil Relief Act (SCRA)—service members can unlock credit cards that civilians pay $550 to $795 annually to access. We're talking about the Chase Sapphire Reserve®, American Express Platinum Card®, and other premium cards that deliver $3,850+ in combined annual value.

The reality: Most military members don't know about these benefits or how to maximize them strategically. This guide changes that.

Understanding Military Credit Card Fee Waivers: MLA vs. SCRA

Before diving into specific cards, you need to understand the two laws that make premium cards accessible with $0 annual fees.

Military Lending Act (MLA):

✅ Applies to credit cards opened while on active duty

✅ Covers active duty servicemembers and spouses

✅ Limits APR to 36% on covered credit

✅ Chase interprets this to waive all personal card annual fees

Servicemembers Civil Relief Act (SCRA):

✅ Applies to accounts opened before entering active duty

✅ Covers servicemembers only (not automatic for spouses)

✅ Reduces interest rates to 6% on pre-service debt

✅ Must request SCRA benefits from card issuer

Which issuers waive fees?

- Chase: Waives fees on all personal cards under MLA (opened during active duty) for servicemembers and spouses

- American Express: Waives fees on all personal cards under both MLA and SCRA

- Capital One: Typically waives under SCRA; MLA varies

- Citi: Waives under SCRA and some MLA cases

- Bank of America, Barclays, U.S. Bank, Wells Fargo: Varies—always verify before applying

💡 Key takeaway: Chase and American Express offer the most generous military benefits, making them your top priorities.

The Strategic Approach: Which Card to Get First

Here's where most military members make a critical mistake: applying for random cards without strategy.

The problem: Chase has a "5/24 rule"—you can only be approved for Chase cards if you've opened fewer than 5 credit cards (from any issuer) in the past 24 months.

The ROI math:

If you open 5 random cards first, then try for Chase Sapphire Reserve®, you'll be denied—missing out on $1,455+ in annual value from a single card ($795 waived annual fee + $300 travel credit + $360+ in other benefits).

The smart order:

- Start with Chase cards first (because of 5/24 rule)

- Then move to American Express (no 5/24 restriction)

- Finally explore other issuers

This sequence maximizes your welcome bonuses while ensuring you don't get locked out of the most valuable cards.

The #1 Card for Military Members: Chase Sapphire Reserve®

Annual Fee: $795 (waived to $0 for military + spouses)

Why it's the best military credit card:

💰Annual Travel Credit

- Automatically applies to any travel purchase

- Hotel stays, flights, rental cars, parking, tolls all qualify

- No hoops to jump through—it's essentially $300 cash

✈️ Premium Travel Earnings

🛫 Airport Lounge Access Worth $469+

- Complimentary Priority Pass™ Select membership (1,300+ lounges worldwide)

- Access to every Chase Sapphire Lounge® by The Club with two guests

- Real scenario: PCS move from JBLM to Ramstein? Free meals, drinks, and comfortable seating during your layovers

💎 Elite-Level Perks

Best for: Service members who travel frequently (PCS moves, TDY, leave), dine out regularly, and want the simplest premium card to maximize.

[[ SINGLE_CARD * {"id": "510", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "$300 Annual Travel Credit"} ]]

The Ultimate Luxury Experience: The Platinum Card® from American Express

American Express Platinum Card® (See Rates & Fees)

Annual Fee: $895 (waived to $0 for military under SCRA/MLA)

Why military members love it:

🎬Digital Entertainment Credit

🚗 Uber Benefits

✈️ Airline Fee Credit

🛍️ lululemon Credit

🏨 Annual Hotel Credit

💡 CLEAR® Plus Credit

🛫 Premium Lounge Access

- Centurion Lounges (most exclusive)

- Priority Pass Select (1,300+ lounges)

- Delta Sky Club when flying Delta

- Plaza Premium, Lufthansa lounges, and more

- Access value exceeds $850 annually

🏨 Elite Status Included

- Hilton Honors Gold Status

- Marriott Bonvoy Gold Elite Status

- Complimentary National Car Rental Emerald Club Executive status

- Enrollment is required

The reality check:

The Platinum Card offers $2,500+ in potential annual value, but requires active engagement. You must enroll in credits, select airlines, and track semi-annual periods.

Best for: Military members willing to maximize credits strategically, frequent travelers who value lounge access, and those seeking hotel elite status.

[[ SINGLE_CARD * {"id": "106", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Serious Points on Flights"} ]]

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Three More Premium Cards Worth Considering

For Hotel Loyalists:

Hilton Honors American Express Aspire Card

Annual Fee: $550 (waived for military)

Real scenario: That TDY to DC? Complimentary breakfast for your family at the Hilton, free room upgrades when available, and late checkout—all from Diamond status. The free night alone can be worth $500+ at luxury properties.

Marriott Bonvoy Brilliant® American Express® Card (See Rates & Fees)

Annual Fee: $650 (waived for military)

For Frequent Flyers:

Delta SkyMiles® Reserve American Express Card (See Rates & Fees)

Annual Fee: $650 (waived for military)

Best for: Service members stationed near Delta hubs (ATL, MSP, DTW, SEA) or who fly Delta frequently for TDY/leave.

[[ SINGLE_CARD * {"id": "781", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Most Premium Delta Offer"} ]]

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Bottom Line: Military Credit Cards Are a Game-Changer

Military members have access to some of the most valuable credit card benefits available. With annual fees waived on premium cards, servicemembers can access:

- $1,000+ in annual fee savings across multiple cards

- Premium travel benefits (lounge access, travel credits, insurance)

- Excellent earning rates on travel and dining

- Welcome bonuses worth $1,000+ in travel value

The combination of fee waivers and premium benefits makes military credit cards one of the best financial benefits of military service.

Ready to maximize your military credit card benefits? Not sure which cards are right for your spending? Our free Dream Wallet tool analyzes your spending to show you exactly which cards would provide the most value based on your lifestyle.

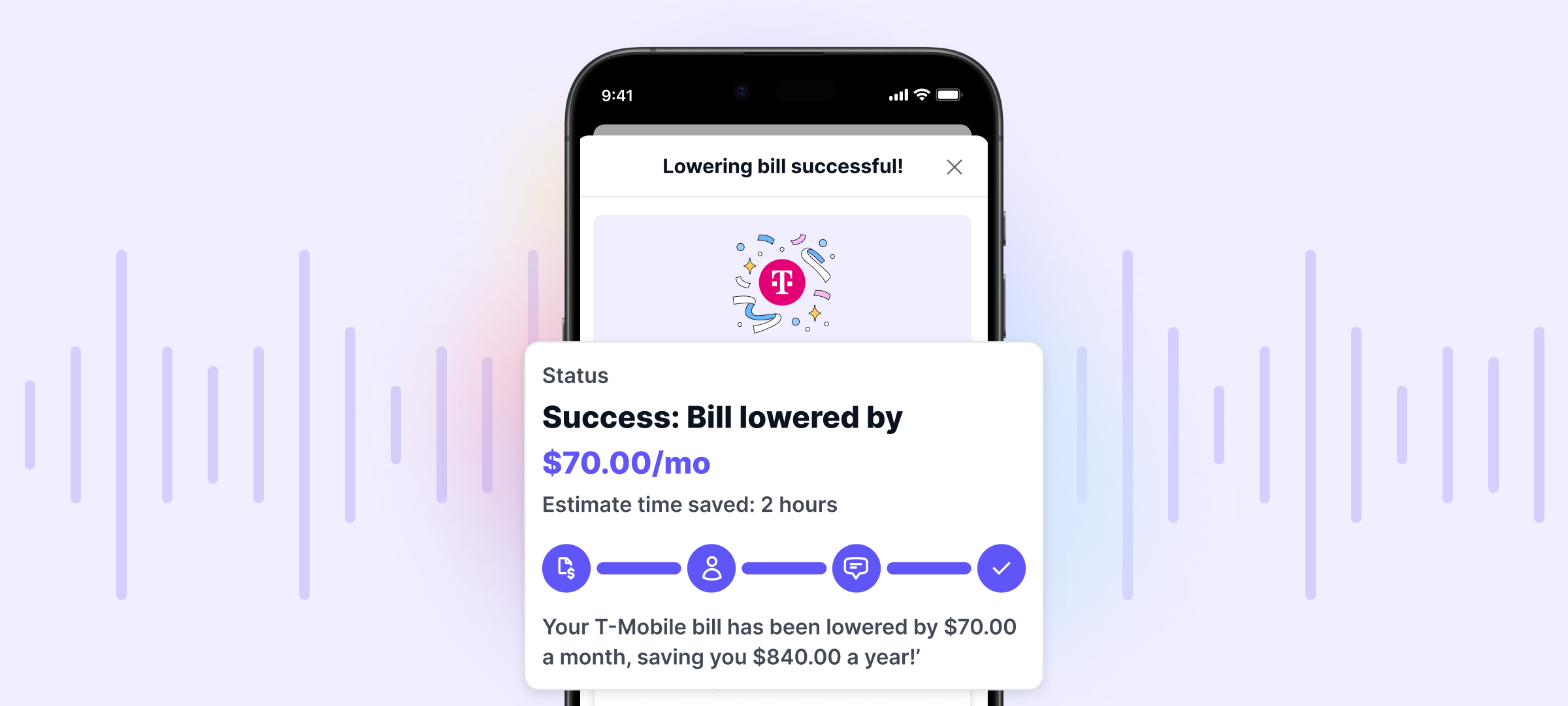

Using Kudos to Maximize Your Military Credit Card Strategy

Once you have 2-3 premium military cards with waived fees, a new challenge emerges: Which card should you use for each purchase?

This is where Kudos becomes your strategic advantage.

How Kudos helps military cardholders:

📊 Automatic card optimization

- Kudos analyzes every purchase in real-time

- Recommends the card earning maximum rewards

- Example: Dining at Chili's on base? Kudos suggests Chase Sapphire Reserve® (3x points) over Amex Platinum (1x points)

💰 Tracks unused benefits worth $624/year

- That CSR travel credit? Kudos reminds you

- Amex airline credit about to expire? You'll know

- Free hotel nights approaching expiration? Tracked automatically

🎯 Identifies hidden savings

- Average Kudos user saves $441/year by using the optimal card

- Combines with military fee waivers for maximum value

Real military scenario:

Captain Martinez has Chase Sapphire Reserve®, Amex Platinum, and Hilton Aspire. She's planning a PCS move from Fort Hood to Okinawa.

Without Kudos:

- Might use wrong cards for different purchases

- Could forget to use CSR travel credit on flights

- May miss Hilton resort credit at her stopover hotel

- Potential loss: $741+ in unused benefits

With Kudos:

- Gets notification to use CSR for flight

- Reminder to apply Hilton resort credit during Hawaii layover

- Optimizes every purchase during move for maximum rewards

- Potential gain: $741+ in captured value + optimized earnings

Sign up for Kudos free with code "GET20" and earn $20 back after your first eligible purchase—use it toward your next TDY hotel!

The Application Path: Step-by-Step Strategy

Timeline for military members starting from scratch:

Month 1-3: Build Credit Foundation (if needed)

- If credit score below 700: Open USAA or Navy Federal card

- Make small purchases, pay in full monthly

- Goal: Build 720+ credit score

Month 4: Start with Chase

- Apply for Chase Sapphire Reserve® (or Sapphire Preferred if higher bonus)

- Alternative: Start with Chase Freedom Unlimited® if building Chase relationship

- Meet $5,000 minimum spend over 3 months

Month 7: Add Second Chase Card

- Chase Sapphire Preferred®

- World of Hyatt Credit Card

- IHG One Rewards Premier Credit Card

Month 10: Move to American Express

- Apply for the Platinum Card® from American Express

- Meet minimum spend requirement

- Enroll in all statement credits immediately

Month 13+: Strategic Expansion

- American Express Hilton Honors Aspire (if you stay at Hiltons)

- Marriott Bonvoy Brilliant® (if you prefer Marriott)

- Delta Reserve (if you fly Delta frequently)

Critical rules to follow:

⚠️ Never carry a balance—Pay in full every month

⚠️ Space applications 90 days apart—Avoid too many hard inquiries

⚠️ Meet minimum spends naturally—Don't manufacture spending

⚠️ Track annual fee schedules—Know when fees would be charged after leaving service

What Happens When You Leave Active Duty?

Your options when separating:

Option 1: Downgrade to No-Fee Versions

- Chase Sapphire Reserve® → Chase Freedom Unlimited®

- Keeps account history, avoids fee

- Lose premium benefits

Option 2: Keep Cards Worth the Fee

- If you value benefits > annual fee, keep it

- Example: CSR's travel credit + lounge access may justify $795 fee

- Do the math based on your actual usage

Option 3: Cancel Cards You Don't Use

- Close before annual fee posts

- Minimal credit score impact if you keep oldest accounts open

- Temporary 60-100 point drop recovers within months

Option 4: Transfer to Spouse (if spouse remains active duty)

- Add spouse as primary on new accounts

- Close your versions before fees hit

- Maintains household benefits

Strategic timeline:

9-12 months before separation:

- Review which cards provide value without fee waivers

- Calculate break-even for each card

- Plan downgrade/cancel strategy

3-6 months before separation:

- Use all remaining credits/benefits

- Redeem points for maximum value

- Apply for any final cards if staying in reserves

Upon separation:

- Monitor accounts for fee postings

- Execute downgrade/cancel plan

- Keep oldest no-fee cards open for credit history

FAQ

Do spouses of active duty members qualify for MLA fee waivers?

Yes, under MLA, spouses of active duty servicemembers qualify for fee waivers on Chase and American Express personal cards. Both Chase and Amex interpret MLA to include spouses, so you can each hold premium cards with $0 annual fees.

Can I apply for these cards before going on active duty?

Yes, but the strategy differs. Cards opened before active duty qualify under SCRA (not MLA). Apply for cards that offer SCRA benefits, like Capital One Venture X, before commissioning/enlisting. Then apply for Chase and Amex cards after you're on active duty to get MLA benefits.

Will opening multiple cards hurt my credit score?

Short-term, yes—expect a 5-10 point drop per application from hard inquiries. Long-term, no—your score recovers within months and improves as you age accounts and maintain low utilization. Most military members with 8-12 cards maintain 750-820 credit scores.

How do I prove I'm on active duty?

Provide a copy of your military ID, recent LES (Leave and Earnings Statement), or orders showing active duty status. Chase and Amex have military benefits departments that handle verification. Process takes 2-6 weeks typically.

Can military members hold multiple of the same card?

Yes! This is a powerful strategy. You can hold multiple Chase Sapphire Reserve® cards or multiple Amex Platinum cards. Each card has its own travel credit (CSR) or credits (Platinum). However, you can only earn the welcome bonus once per card per lifetime.

What if I'm deployed—can I still apply?

Yes, you can apply while deployed. Most applications are instant approval or pending review. Some servicemembers wait until return from deployment to manage minimum spending requirements more easily.

Does Kudos work with military credit cards?

Yes! Kudos works with over 3,000 credit cards, including all military cards with fee waivers. Link your cards to automatically get recommendations on which card to use for maximum rewards on every purchase. Sign up free here.

Are National Guard and Reserve members eligible?

Guard and Reserve members qualify when on active duty orders for 30+ days. MLA protections apply during active duty periods. SCRA applies if called to active duty after opening accounts.

Bottom Line

If you're on active duty, you have access to a benefit that civilians would gladly pay thousands for: premium credit cards with $0 annual fees.

The opportunity:

- Chase Sapphire Reserve®: $1,455+ in annual value

- Amex Platinum: $2,500+ in annual value

- Hilton Aspire: $1,150+ in annual value

- Combined potential: $5,105+ across just three cards—all free

The strategy:

- Start with Chase Sapphire Reserve® for simplicity and maximum value

- Add Amex Platinum for luxury benefits and lounge access

- Choose one hotel card (Hilton Aspire or Marriott Brilliant) based on your stays

- Use Kudos to optimize which card to use and track benefits

The timeline:

- Month 1-4: Chase Sapphire Reserve®

- Month 7-10: Amex Platinum

- Month 13+: Hotel card

- Ongoing: Use Kudos to maximize every purchase

Critical reminders:

- ✅ Apply for Chase cards first (5/24 rule)

- ✅ Never carry a balance

- ✅ Meet minimum spends naturally

- ✅ Enroll in all statement credits

- ✅ Use Kudos to track benefits and optimize earnings

This benefit exists because of your service. Take advantage of it strategically, and you can travel better, dine out smarter, and build wealth faster—all while serving your country.

Ready to maximize your military credit card benefits? Join over 400,000 Kudos members who are already earning more rewards and never missing a credit again.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)

.webp)