Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Can You Pay Carvana with A Credit Card? The Truth About Earning Rewards on Your Car Purchase

July 1, 2025

Can You Pay Carvana with a Credit Card? The Quick Answer

Short Answer: Yes, but only for down payments—and with significant limitations.

Here's what you need to know immediately:

What Carvana DOES Accept Credit Cards For:

- ✅ Down payments (with dollar limits—typically a few hundred to ~$2,000)

- ✅ Deposits to secure your vehicle

What Carvana DOES NOT Accept Credit Cards For:

- ❌ Full vehicle purchase price

- ❌ Monthly loan payments

- ❌ Final purchase amount (must use financing, bank transfer, or cashier's check)

Accepted Credit Cards:

- Visa®

- Mastercard®

- American Express®

- Discover®

Processing Fees: None from Carvana (but watch out for potential cash advance classification by your card issuer)

The Reality: While Carvana's credit card policy sounds appealing—no processing fees, all major cards accepted—the dollar limits severely restrict your ability to earn meaningful rewards or leverage 0% APR offers on the full purchase.

The Down Payment Limit: How Much Can You Actually Charge?

Carvana doesn't publicly advertise exact credit card limits, but based on customer experiences and our research, here's what to expect:

Typical Credit Card Limits at Carvana:

- Minimum: $200-300 (enough for a deposit)

- Common Range: $500-$2,000

- Maximum Reported: ~$2,000 (varies by purchase and creditworthiness)

The Restriction:

Even if you have a $25,000 credit limit and are buying a $20,000 car, Carvana caps credit card payments well below the vehicle price. This is a fraud prevention and risk management strategy common across online auto retailers.

Real-World Scenario:

Sarah's Carvana Purchase:

- Vehicle price: $18,500

- Down payment required: $3,000

- Credit card limit at Carvana: $2,000

- Remaining down payment needed: $1,000 (bank transfer, debit card, or certified check)

Why the Limit Exists:

- Fraud Protection: Large credit card transactions trigger fraud alerts and increase chargeback risk

- Processing Costs: Even though Carvana doesn't charge you a fee, they pay ~2-3% in processing fees to card networks

- Credit Card APRs: Auto loans (4-10%) are much cheaper than credit card interest (20-30%), so Carvana incentivizes traditional financing

ROI Reality Check: How Much Can You Actually Earn?

Let's calculate the real rewards value of using a credit card for your Carvana down payment.

Scenario: $2,000 Down Payment (Maximum Typical Limit)

Option 1: Flat Cash Back Card (2%)

- Charge: $2,000

- Rewards earned: $40 cash back

- Net benefit: $40

Option 2: Flat Cash Back Card (1.5%)

- Charge: $2,000

- Rewards earned: $30 cash back

- Net benefit: $30

Option 3: Sign-Up Bonus Strategy

- Charge: $2,000 toward $5,000 minimum spend requirement

- Sign-up bonus: 75,000 points (worth ~$750-937 depending on redemption)

- Rewards on purchase: $30-40

- Total potential value: $780-977 (from entire $5,000 spend, not just Carvana portion)

Option 4: 0% APR Card

- Charge: $2,000

- Pay off over 21 months interest-free

- Interest saved vs. auto loan at 7%: ~$147

- Net benefit: $147 savings

The Verdict:

For maximum value, use your Carvana down payment strategically as part of a larger credit card optimization strategy—either knocking out a sign-up bonus requirement or leveraging 0% APR to preserve cash flow.

The Hidden Credit Utilization Trap Nobody Warns You About

Here's the danger most articles skip: charging $2,000 to a credit card can torpedo your credit score right when you need it most—for auto loan approval.

The Credit Utilization Problem:

Credit utilization (the percentage of available credit you're using) accounts for 30% of your FICO® score. Experts recommend keeping utilization below 30%, ideally below 10%.

Real-World Example:

Your Credit Card:

- Credit limit: $5,000

- Current balance: $500 (10% utilization)

- Credit score: 750

After Charging $2,000 Carvana Down Payment:

- New balance: $2,500 (50% utilization)

- Potential score drop: 30-50 points

- New credit score: 700-720

Why This Matters for Car Loans:

If Carvana pulls your credit for financing after you charge the down payment, your temporarily inflated utilization could:

- Reduce loan approval odds

- Increase your APR (potentially costing $500-2,000 over the life of the loan)

- Lower your approved loan amount

The Solution: Strategic Timing

- Option A: Use a card with a high credit limit (charge $2,000 on a $20,000 limit = only 10% utilization)

- Option B: Get pre-approved for financing before charging the down payment

- Option C: Pay off the credit card balance before the statement closes (utilization reports at statement close)

Best Credit Cards for Carvana Down Payments: Strategic Recommendations

Since you can only charge $2,000 maximum, the right card depends on your primary goal.

1. Wells Fargo Reflect® Card – Best for Interest-Free Financing

[[ SINGLE_CARD * {"id": "3351", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Large Purchasers", "headerHint": "0 Annual Fee"} ]]

2. Citi® Diamond Preferred® Card – Best for Balance Transfer + Purchase Flexibility

[[ SINGLE_CARD * {"id": "574", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "0% APR Seekers", "headerHint": "Free FICO Access"} ]]

3. Chase Freedom Unlimited® – Best for Ongoing Rewards

[[ SINGLE_CARD * {"id": "497", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "Fantastic Cash Back Card"} ]]

4. Blue Cash Everyday® Card from American Express – Best for Everyday Spending Categories

[[ SINGLE_CARD * {"id": "260", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Reward Seekers", "headerHint": "Cash Back Rewards Program"} ]]

5. Citi Custom Cash® Card – Best for Flexible Bonus Categories

[[ SINGLE_CARD * {"id": "2885", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "Flexible Cash Back Card"} ]]

Step-by-Step: How to Maximize Value When Paying Carvana with Credit Card

Follow this process to extract maximum rewards while minimizing risk:

Step 1: Check Your Credit Report and Score (2-4 Weeks Before Purchase)

Why: You need to know your starting point to assess credit utilization impact.

- Get your free credit report at AnnualCreditReport.com

- Check your FICO® score through your credit card issuer or a free service

- Look for errors and dispute them before applying for auto financing

Step 2: Get Pre-Approved for Carvana Financing (1-2 Weeks Before)

Why: Lock in your auto loan rate before charging the down payment (protecting against credit utilization damage).

- Visit Carvana's website and complete the pre-qualification form

- Soft pull only—won't impact your credit score

- Receive loan terms and rate estimates

Step 3: Apply for the Right Credit Card (2-3 Weeks Before)

Why: Ensure card approval and delivery before your Carvana purchase deadline.

Step 4: Notify Your Credit Card Issuer (1 Day Before Purchase)

Why: Prevent fraud alerts from declining your Carvana transaction.

- Call the number on the back of your card

- Inform them: "I'm making a $2,000 vehicle down payment to Carvana tomorrow"

- Confirm there are no holds or restrictions

Step 5: Complete Your Carvana Purchase Strategically

During Checkout:

- Select credit card as payment method for down payment

- Enter card information

- Use bank transfer/cashier's check for remaining down payment (if needed)

- Verify your card was charged (not processed as cash advance)

Verify Immediately:

- Log into your credit card account

- Confirm the charge appears as a "purchase" not "cash advance"

- If it's a cash advance, call Carvana AND your card issuer immediately to resolve

Step 6: Monitor Your Credit Utilization

Within 24-48 Hours:

- Check your credit card balance

- Calculate new utilization percentage

- If above 30%, make an immediate payment to bring it down before statement close

Step 7: Create a Payoff Plan

For 0% APR Cards:

- Divide balance by intro period length (e.g., $2,000 ÷ 21 months = $95.24/month)

- Set up autopay for this amount + $10 buffer

- Pay off completely before intro period ends

For Rewards Cards:

- Pay in full by statement due date to avoid interest

- Preserve 0% APR for other purchases if applicable

Carvana Payment Methods: Complete Breakdown

To understand the full picture, here's every payment method Carvana accepts and for what purpose:

Down Payment & Deposit Options:

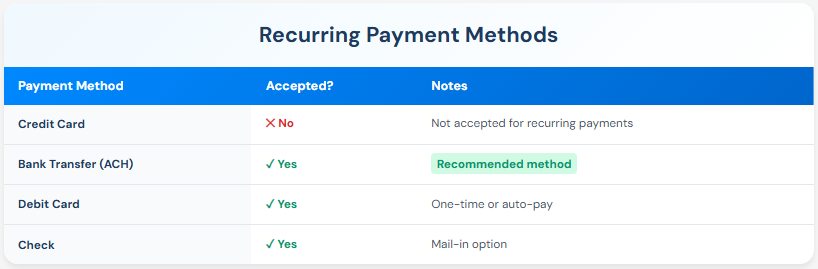

Monthly Payment Options:

Key Takeaway: Credit cards are strictly limited to the initial down payment/deposit phase. You cannot use credit cards for monthly loan payments.

Common Mistakes to Avoid (That Could Cost You Thousands)

Mistake #1: Assuming You Can Charge the Full Purchase Price

The Error: Planning to put a $15,000 car on your credit card to earn 30,000 points.

The Reality: Carvana caps credit card payments at ~$2,000 maximum.

The Cost: Missed rewards opportunity + potential credit utilization damage if you max out a card trying to test the limit.

Mistake #2: Ignoring Cash Advance Risk

The Error: Not verifying how your card issuer codes Carvana transactions.

The Reality: Some issuers may code auto purchases as "cash advances" instead of "purchases."

Cash Advance Consequences:

- Immediate 5% fee ($100 on $2,000)

- Interest starts accruing immediately (no grace period)

- APR often 25-30%+

- Total cost of $2,000 cash advance over 6 months: $2,250+

Prevention: Call your issuer before purchasing and verify Carvana codes as a standard purchase.

Mistake #3: Charging Down Payment Before Loan Approval

The Error: Charging $2,000 to a credit card, spiking utilization to 60%, then applying for financing.

The Reality: Your temporarily high utilization tanks your credit score, resulting in:

- Higher APR (potentially 2-3% higher)

- Cost over 60-month loan: $1,200-1,800 extra in interest

Prevention: Get pre-approved for financing before charging the down payment.

Mistake #4: Missing the 0% APR Payoff Deadline

The Error: Charging $2,000 to a 0% APR card, paying minimums, then forgetting about it until month 22.

The Reality:

- Month 22: $500 balance remaining

- 0% period ends

- New APR: 24.99%

- Interest accrued on remaining balance: $125+ over next year

Prevention: Set up autopay for the exact amount needed to pay off before the intro period ends.

Mistake #5: Not Considering Total Cost of Ownership

The Error: Focusing solely on down payment rewards, ignoring the auto loan APR.

The Reality:

- Earn $40 in credit card rewards

- Accept a 9% auto loan (because your credit utilization spiked)

- Cost over loan term: $2,000+ extra vs. 6% loan

Prevention: Optimize for the auto loan rate first, credit card rewards second.

How Kudos Maximizes Your Carvana Purchase (And Every Purchase After)

Even with Carvana's credit card restrictions, Kudos ensures you're always using the optimal card for maximum rewards.

What Kudos Does for Your Carvana Purchase:

- Pre-Purchase Optimization: Kudos analyzes your existing cards and recommends the best one for your $2,000 Carvana down payment based on:

- Current sign-up bonus progress

- 0% APR availability

- Highest rewards rate

- Credit utilization impact

- Ongoing Rewards Maximization: After your car purchase, Kudos automatically selects the best card for every transaction:

- Gas stations: Use card with 3-5% gas rewards

- Car insurance: Use card with best base rate

- Maintenance: Use card working toward sign-up bonus

- Credit Utilization Monitoring: Kudos tracks your utilization across all cards and alerts you when you're approaching the 30% threshold that could damage your score.

- Hidden Benefits Discovery: Kudos identifies car-related perks you're not using:

- Rental car insurance (primary vs. secondary)

- Extended warranty protection

- Roadside assistance benefits

- Purchase protection for car accessories

The Kudos Advantage: Real Scenario

Without Kudos: You charge $2,000 Carvana down payment to your everyday 1.5% cash back card:

- Rewards earned: $30

- Annual car expenses ($3,000 gas, insurance, maintenance): $45 rewards

- Total: $75/year

With Kudos: Kudos routes every purchase to the optimal card:

- $2,000 Carvana down payment → Card working toward $500 sign-up bonus

- $3,000 annual gas → Card with 3% gas rewards = $90

- $1,200 insurance → 2% card = $24

- Total value: $614/year (sign-up bonus + optimized rewards)

Annual Benefit: $539 more just by using the right card at the right time.

Frequently Asked Questions

Can I use multiple credit cards for my Carvana down payment?

Yes. Carvana allows you to split your down payment across multiple payment methods, including multiple credit cards. For example, you could charge $1,000 to one card and $1,000 to another. This strategy can help manage credit utilization across multiple cards.

Will using a credit card affect my Carvana financing approval?

The down payment method itself doesn't affect approval. However, the credit utilization impact from charging the down payment could temporarily lower your credit score if it significantly increases your balance. To avoid this, either use a card with a high limit or get pre-approved before charging the down payment.

Does Carvana charge a processing fee for credit card payments?

No. Unlike some auto dealers, Carvana does not charge processing fees for credit card down payments. However, your card issuer may code the transaction differently (see cash advance warning above).

Can I use a credit card for monthly Carvana loan payments?

No. Carvana does not accept credit cards for recurring monthly loan payments. You must use bank transfer (ACH), debit card, or check. This is standard across auto lenders.

What if my credit card issuer declines the Carvana charge?

Large, unusual transactions often trigger fraud alerts. To prevent this: (1) Notify your card issuer 24 hours in advance, (2) Confirm your contact information is current, (3) Have a backup payment method ready (bank transfer or debit card), (4) Call your issuer immediately if declined to verify the transaction.

Can I earn sign-up bonuses by charging my Carvana down payment?

Absolutely. Your Carvana down payment ($2,000) counts as a regular purchase toward minimum spending requirements. If you need to spend $5,000 in 3 months for a sign-up bonus, the Carvana charge gets you 40% of the way there.

Will I get purchase protection on my Carvana down payment?

This is tricky. Purchase protection typically covers theft or damage to items purchased with your card. Since the down payment is a service (financing), not the car itself, most credit cards won't extend purchase protection to the down payment. However, some premium cards may offer additional coverage—check your benefits guide.

What happens if I return the car to Carvana after charging my down payment?

Carvana offers a 7-day return policy (or longer in some states). If you return the car, your down payment is refunded via the original payment method. If you paid via credit card, the refund goes back to your credit card (typically within 5-10 business days). Note: This refund doesn't immediately reverse the credit utilization impact—it takes 1-2 billing cycles to reflect on your credit report.

The Bottom Line: Strategic, Not Simple

Using a credit card for your Carvana down payment can deliver value—but only if you navigate the restrictions strategically.

The Reality Check:

- Maximum credit card charge: ~$2,000 (not $15,000)

- Potential rewards: $30-120 on the down payment itself

- Real value: Using it strategically as part of a sign-up bonus or 0% APR plan

- Risk: Credit utilization spike damaging your score and costing you thousands in higher auto loan APR

Who Should Use a Credit Card for Carvana:

- High credit limit cardholders ($10,000+ limit, so $2,000 charge = only 20% utilization)

- Sign-up bonus hunters (use Carvana charge toward minimum spend requirement)

- 0% APR strategists (finance $2,000 interest-free for 15-21 months)

- Those with secured financing (already pre-approved at a great rate, so utilization spike doesn't matter)

Who Should Skip the Credit Card:

- Low credit limit holders ($5,000 or less—$2,000 charge = 40%+ utilization)

- Those without pre-approved financing (credit score matters for loan rate)

- Cash advance risk (if your issuer might code it as cash advance)

- Those who can't pay off quickly (will carry balance and accrue interest)

The Smarter Strategy:

- Pre-approve your auto loan first (lock in your rate before impacting utilization)

- Choose a 0% APR card with high limit (minimize utilization impact)

- Use down payment toward sign-up bonus (maximize value beyond 1-2% cash back)

- Pay off before statement closes (avoid reporting high utilization to credit bureaus)

- Use Kudos to optimize every future car-related purchase (gas, insurance, maintenance)

The $30-40 in rewards from a $2,000 down payment isn't game-changing. The $500-1,000 sign-up bonus you earn by using that charge strategically? That's worth the effort.

Ready to maximize rewards on every purchase, not just Carvana? Try Kudos for free and see exactly which card delivers the most value based on your real spending patterns.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)