Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

The Different Types of Credit Cards You Should Have and Why

July 1, 2025

The average American has at least three credit cards in their wallet. Does that sound like you?

While having multiple credit cards can be helpful, juggling too many can be stressful, chaotic, and even hurt your credit score.

It's important to know which of your credit cards deserve to stay in your wallet and which ones you should toss.

We’ll discuss the four types of credit cards worth carrying around and why they’re important. Plus, we’ll tell you about five popular credit cards in each category to make finding your next card a piece of cake.

The Four Different Types of Credit Cards You Should Have

There are four main types of credit cards worth having. These are:

- Rewards credit cards

- Low/zero-interest credit cards

- Cards for establishing credit

- Private label/co-branded credit cards

Let’s run through each type to explain why it’s worthwhile.

The Breakdown

1. Rewards credit cards

As the name implies, rewards credit cards reward you for making purchases and paying bills. They’re a way for you to save money while spending money. They may give out rewards at fixed or boosted rates depending on what they’re being used for.

Rewards credit cards usually give out rewards in the following three forms:

- Cashback: This type of credit card offers you a percentage of your cash back after each purchase. The cashback stays on your card, and you can use it to lower your balance owing or to make purchases.

- Card points: Instead of giving you cashback rewards, some cards give you points that you can redeem for cash or other exclusive benefits.

- Travel miles: These are popular with airline-branded credit cards. They offer miles that you can redeem on flight tickets.

When to use a rewards card

Your rewards credit card should be the card you use for regular expenses and payments, such as groceries, bills, and subscriptions. The type of rewards program you should sign up for depends on your purchasing habits. For example, if you travel frequently, consider a credit card that offers you travel rewards.

You can have multiple cards of this type if you want to take advantage of different deals.

For example, one may give you 2% back on groceries, but only 1% on everything else. So, if another card gives you 2% back on only fuel purchases, it can make sense to carry both.

Just keep in mind that the more cards you have, the harder it gets to manage them all. Of course, when it comes to online shopping, Kudos can help with this.

Five popular rewards cards to consider and why

[[ SINGLE_CARD * {"id": "2894", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "0 Annual Fee"} ]]

[[ SINGLE_CARD * {"id": "509", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Exceptional Travel Value"} ]]

[[ SINGLE_CARD * {"id": "261", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "Popular Cash Back Card"} ]]

[[ SINGLE_CARD * {"id": "2885", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "Flexible Cash Back Card"} ]]

[[ SINGLE_CARD * {"id": "118", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Generous Travel Rewards"} ]]

2. Zero- and low-interest credit cards

Zero- and low-interest credit cards stand by you when unexpected expenses or situations force you to incur debt on your credit card.

They offer you a way to pay off your outstanding balance with minimal or no interest. Most of these cards come with an introductory rate of 0% that lasts for some time and later offer low regular APRs.

This should be the type of card you turn to in an emergency — not your regular credit card, since these types of cards usually won’t offer any rewards for using them.

When to use a zero- or low-interest credit card

A zero- or low-interest card is ideal for performing balance transfers. Because it offers such low APRs, you can transfer debts from other credit cards to it and pay them off with little to no interest.

Note that the 0% APR is only temporary, usually covering only the first 12 to 21 months. So the trick is to utilize this period as much as possible to pay off all — or at least most — of your debt.

A zero-or low-interest credit card can also help you make major, unexpected purchases that you can't afford to pay off within one billing cycle.

Five popular zero- or low-interest cards to consider and why

[[ SINGLE_CARD * {"id": "3351", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Large Purchasers", "headerHint": "0 Annual Fee"} ]]

[[ SINGLE_CARD * {"id": "821", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "0 Annual Fee"} ]]

[[ SINGLE_CARD * {"id": "497", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "Fantastic Cash Back Card"} ]]

[[ SINGLE_CARD * {"id": "315", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Debtors", "headerHint": "Fantastic Cash Back Card"} ]]

[[ SINGLE_CARD * {"id": "574", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "0% APR Seekers", "headerHint": "Free FICO Access"} ]]

3. Credit-building cards

These cards are meant for those just starting on their credit card journey. While they may not offer as many perks as rewards or low-interest cards, they have relaxed requirements and usually come with no annual fees.

Most credit-building cards are secured cards, meaning that you’ll have to put in a security deposit before using one. After putting down the deposit, you may get between 50% and 100% of your collateral as your credit limit.

Student credit cards can also function as credit-building cards since they don’t require excellent credit scores or charge annual fees.

When to use a credit-building card

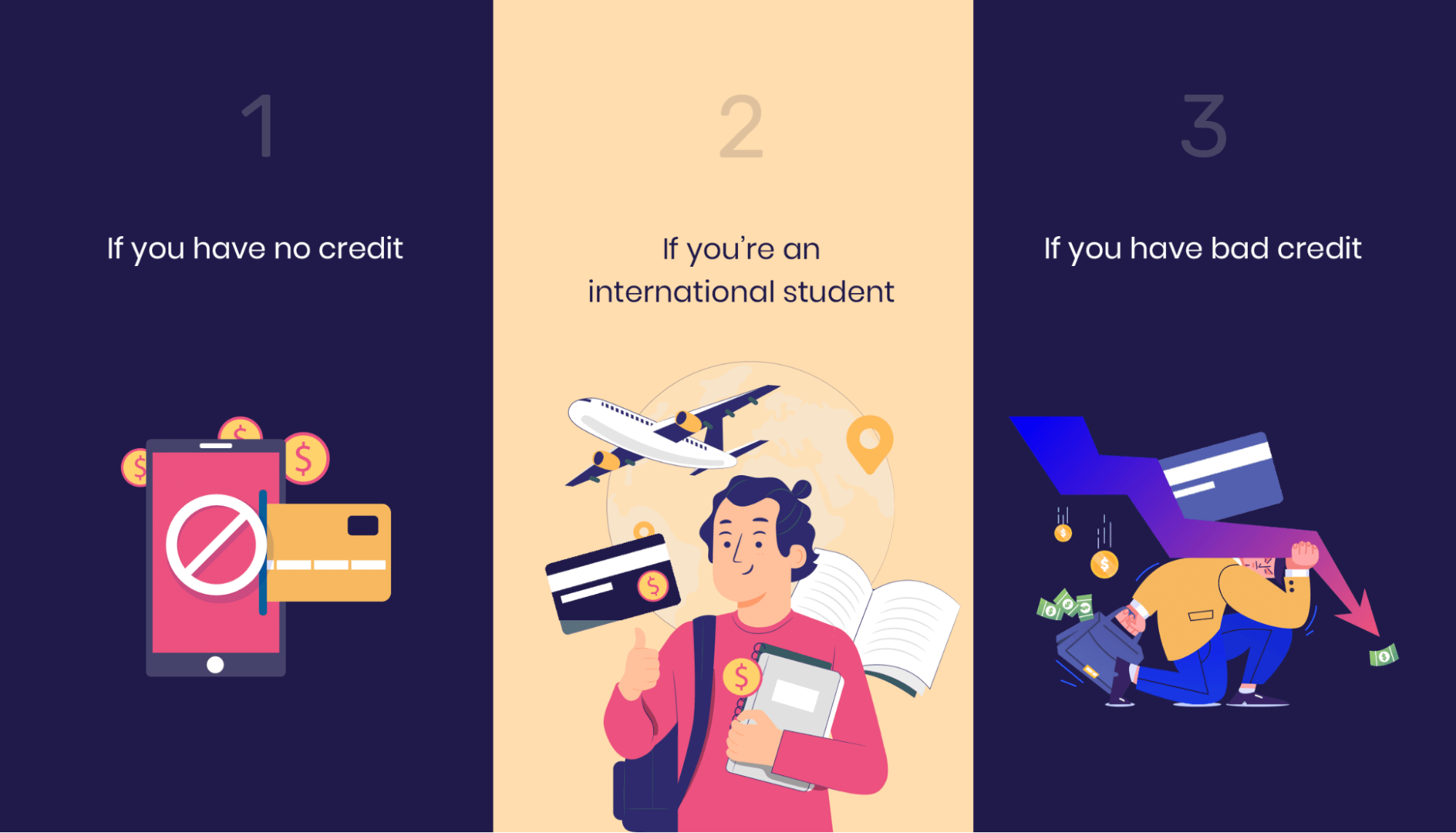

Here are three scenarios where a credit-building card might be worth carrying:

- If you're just starting on your credit card journey: If you have no credit history, most credit card issuers won’t accept you. In this situation, a credit-building card will help you gradually build up your credit score until it is high enough for you to apply for other types of cards.

- If you're an international student studying abroad: Foreign students in the US often find it hard to get cards that don’t ask for their social security number. Fortunately, most credit-building cards don’t do this, making it easier for you to get one.

- If you have a bad credit score: Perhaps you racked up debt and damaged your credit score as a result. You now need to rebuild your score, but you are finding it difficult to do so. In this situation, you need a credit-building card.

Five popular credit-building cards to consider and why

[[ SINGLE_CARD * {"id": "431", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "No Fee Seekers", "headerHint": "No Fee Card"} ]]

[[ SINGLE_CARD * {"id": "827", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Credit Builders", "headerHint": "No Annual Fee Card"} ]]

[[ SINGLE_CARD * {"id": "830", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Students", "headerHint": "Quarterly Rotating Categories"} ]]

[[ SINGLE_CARD * {"id": "3058", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Credit Builders", "headerHint": "1.5% Flat Cash Back"} ]]

[[ SINGLE_CARD * {"id": "2905", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "No Fee Seekers", "headerHint": "No Fees"} ]]

4. Private label and co-branded cards

Unlike traditional credit cards, which you can use anywhere, private label cards are issued by private companies and can usually only be used at a specific company or store. They don't carry the brand logos of credit card companies.

Co-branded credit cards, on the other hand, bear the logos of both the private company and the credit card company. This makes it possible to use them wherever the credit card company is allowed, even outside the original store.

When to use a private label card

If you are loyal to a particular brand, a private label card will come in handy and allow you to save some money as you use the brand’s service.

You can also use a private label card to build up your credit history within your favorite store and then use that history to apply for major credit cards.

Five popular private label/co-branded cards you should consider and why

[[ SINGLE_CARD * {"id": "2257", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Target Shoppers", "headerHint": "No Fees"} ]]

[[ SINGLE_CARD * {"id": "81", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Amazon Shoppers", "headerHint": "5% at Amazon"} ]]

[[ SINGLE_CARD * {"id": "105", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Loyal Hilton Guests", "headerHint": "Compelling Choice"} ]]

[[ SINGLE_CARD * {"id": "421", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Walmart Shopper", "headerHint": "5% at Walmart"} ]]

[[ SINGLE_CARD * {"id": "789", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Convenient Travels"} ]]

Conclusion

Now you know the four major types of credit cards worth carrying. Depending on your needs, your credit score, and the amount of debt you have to pay off, you can juggle between a rewards card, a zero-low interest card, a credit-building card, and/or a private label card.

Watch out for the APR, though, as well as other variables such as foreign transaction fees, balance transfer fees, and late payment penalties to avoid unknowingly incurring credit card debt.

If you're still not sure what choice to make, just add Kudos to your browser extension and let it sift through thousands of cards to find the one that best suits your checkout needs.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)