Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

What to Look for When Choosing a Credit Card

July 1, 2025

Having access to a credit card can have a big impact on your finances.

Owning a credit card can help increase your purchasing power, build your credit score, help you earn rewards, and give you invaluable peace of mind in knowing that you can always make purchases when you need to.

But there are so many credit cards out there that it can be incredibly difficult to know how to find the card that’s right for you. We’re here to help.

This guide will explain how credit card companies look at your applications and the most important factors to bear in mind when choosing a credit card.

What Are the Five C’s of Credit?

Before we break down what to look for when choosing a credit card, it’s important to remember that credit card companies also have to look for certain things before they choose you. By understanding what credit card companies are looking for in the ideal customer, you’ll maximize your chances of approval.

When you apply to get a new credit card, the card’s servicer will need to know that you’re able to pay back any money owed before approving your application. One of the top ways credit card companies test your ability to take on credit is to look at the so-called five C’s of credit: character, capacity, capital, collateral, and conditions.

Character is all about your credit history. Credit card servicers will look at how you’ve managed debt in the past to try to develop a picture of how responsible you’re going to be with a new credit card.

Capacity is all about your ability to repay debts owed.

Then, you’ve got capital. This includes the savings, assets, and other investments you’re willing to pay toward settling any outstanding debts.

Next is collateral. Collateral is an asset (normally cash) that you can provide as security to show that you’re good for the amount of credit you’ve been extended. This is most applicable to secured credit cards, and it takes the form of a cash deposit.

Finally, you’ve got your conditions. These include all the bits of information unique to each credit card that’ll help the company decide whether you should qualify for credit.

But why are the five C’s of credit so important?

They not only help credit companies decide whether to approve your application, but they can also go on to dictate what your credit limit and the interest rate on your card will be. On the flip side, understanding how a credit card works and where you stand in terms of the five C’s will also give you a better idea of whether a credit card is the best option for you.

What Should You Consider When Choosing a Credit Card?

No two credit cards are 100% alike — and neither are the people who use them. That’s why it’s important to do your homework and understand what you’re after before applying to get a new credit card.

To help inspire you, we’ll break down a few key considerations you should be focusing on when choosing a credit card.

Credit score requirements

Unfortunately, credit card issuers don’t usually publish a minimum credit score requirement for each product they offer. But they’ll normally offer a rough guide that should give you a hint as to whether you’re likely to be approved.

For example, you’ll see types of credit cards like credit-building cards, which require security deposits. These cards are designed for people with a poor (or no) credit score. You’ll then see unsecured cards with high credit limits that the issuer will say are designed for spenders with good credit.

When in doubt, dive into your credit report and your credit history before applying for a new credit card. That way, you’ll know where you stand.

If you’re just starting out, the best credit cards for young adults normally accept lower scores with less credit history (but may have lower limits or require a security deposit to match).

How you plan on using your credit card

Next, you’ll want to think about how you plan on using your new credit card.

If you’re looking for one card to use for everyday expenses, you might want to go for a flat-rate rewards card. But if you want to maximize your potential rewards, you may want to think about a rewards card that offers bonus categories.

Then again, you may simply need to work on your credit score after declaring bankruptcy. In that case, you’d want to look at a secured credit card with a low limit. You may also just want a credit card to use in case of an emergency — in which case you’d probably go for a credit card with a high limit, a low interest rate, and no annual fees.

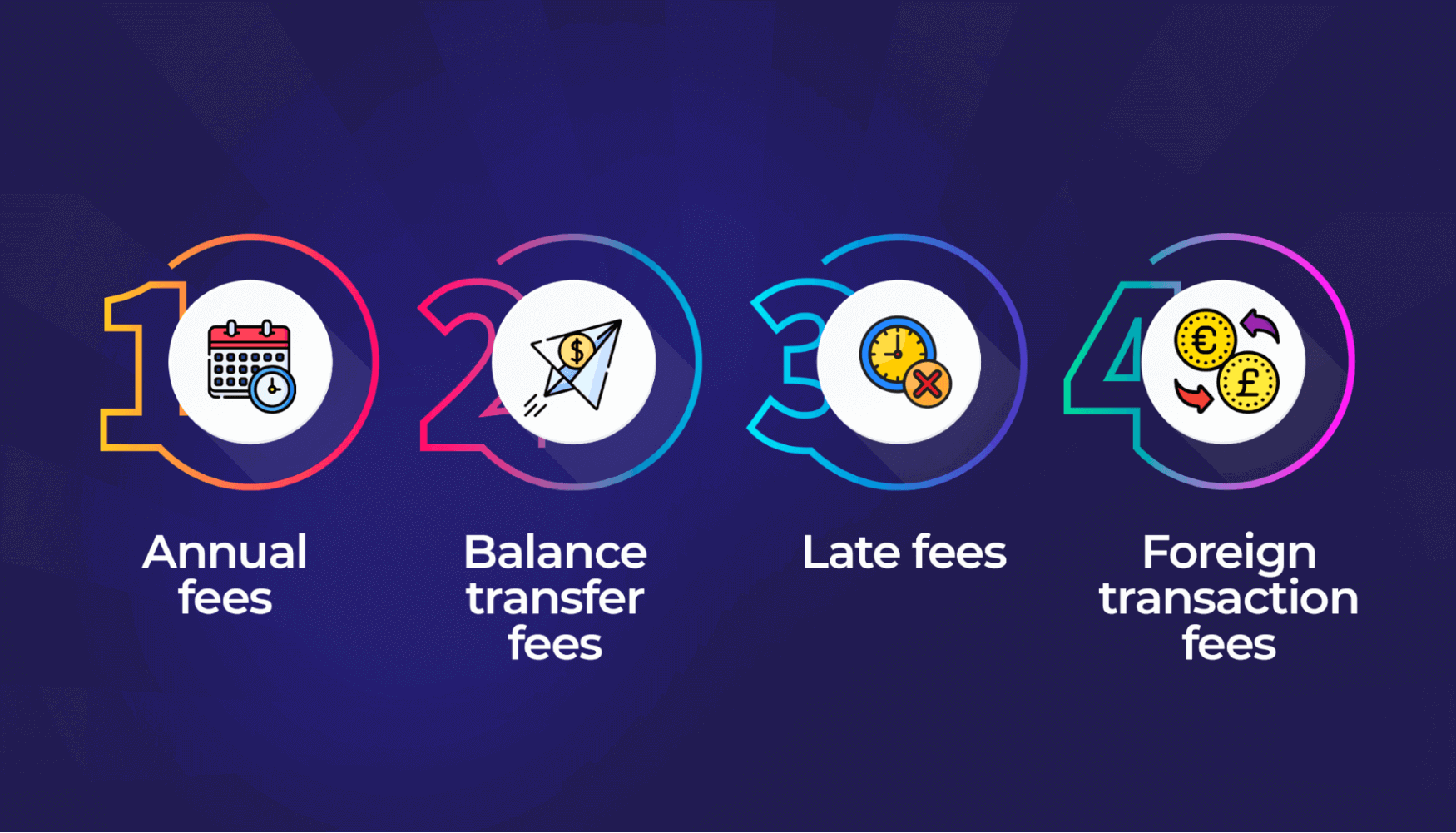

Credit card fees

It’s easy to get excited about prequalifying without reading the fine print on credit card fees — but card fees can add up fast.

First, there’s your annual fee. Annual fees aren’t necessarily bad, but they affect how much value you’re getting out of your card. Some cards don’t make you pay an annual fee. Premium credit cards, however, might require an annual fee, but they offer great benefits to match. And if you’re looking at a card with a high annual fee but no benefits, you may want to think twice.

Next, there are balance transfer fees. These are fees credit card companies charge you to move a balance from one card to another, and they usually hover between 3% and 5%.

You also have to consider the card’s late fee. This is an extra charge you’ll have to pay if you don’t make the minimum payment on your account balance in time. Some credit cards don’t have late fees, but these are few and far between. Generally speaking, if you set up an autopay or direct debit, you’ll be able to avoid late fees.

Finally, there’s the foreign transaction fee. This may apply if you make purchases while on vacation in a foreign country or make online purchases on sites that use foreign currencies. Foreign transaction fees are normally around 3%, but some cards don’t have them (and other cards simply can’t be used in foreign countries).

Credit limit

Your credit limit will determine how high your balance is allowed to go before you’re cut off from making purchases. You’ll normally get approved for an initial credit limit based on your credit score, but you won’t normally know exactly what your limit will be until you get approved.

Some cards have a minimum credit limit, and others offer different minimum limits depending on the particular product you’re applying for.

Some credit card issuers will automatically review your account quarterly or annually and offer you a credit limit increase if you’re using your card responsibly. You may also be able to ask for a credit limit increase on an open card — but this could require your credit card servicer to do a hard credit check. That’s not necessarily a bad thing, but it could slightly affect your credit score.

Annual Percentage Rate (APR)

Your credit card’s Annual Percentage Rate (APR) dictates how much interest accrues when you carry a balance over from one month to the next. If you pay off a card’s total balance by the end of each month, you won’t have to pay any interest (unless you set other pay-by dates).

If you’re applying for a credit card because you need to make a big purchase and want to pay it off over time, you should look for a card with a 0% APR promotional offer. You can also find balance transfer cards with a 0% promotional offer during certain time periods.

Be aware that cash advances will often have a different (and usually higher) APR rate. You’ll probably have to pay this rate even if you’re in a 0% APR intro offer, so do your homework and make sure you understand the fee structure of your new card.

Rewards

Rewards cards offer you incentives for spending — including cash back, air miles, or points on eligible purchases. There are three basic types of rewards cards you can expect to see: flat-rate rewards cards, tiered-rate rewards cards, and rotating rewards cards.

Flat-rate rewards cards offer the same rewards on every eligible purchase, while tiered-rate rewards cards give you bonus rewards on certain purchases. Rotating rewards cards give you different bonus categories that change every month or two.

Before taking on a rewards card, think about the kinds of rewards you’re trying to earn, and whether your spending justifies the annual fee.

Cash back is probably going to be the most useful reward on a day-to-day basis — but cards that let you accumulate and spend rewards points can be super flexible and offer great value. Meanwhile, cards that offer airline miles or hotel points will be perfect if you travel a lot (or want to start traveling more).

Conclusion

At the end of the day, no two credit cards are identical. So, before you start shopping around for a credit card, you should consider how credit card companies will review your application.

You’ve then got to think about what it is you want in a card. That means thinking about credit score requirements, credit limits, fees, interest rates, and rewards. It also means taking your time, doing your homework, and not being afraid to ask experts for help when required.

Need a hand managing your credit cards? Kudos sorts through data across 3,000+ cards and millions of online merchants. That means when you’re ready to check out, we’ll scan your wallet to tell you how you should pay and what rewards and benefits you’ll get on that purchase.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)