Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Winter Storm Fern Flight Cancellations: How Your Credit Card Can Help Save Hundreds

July 1, 2025

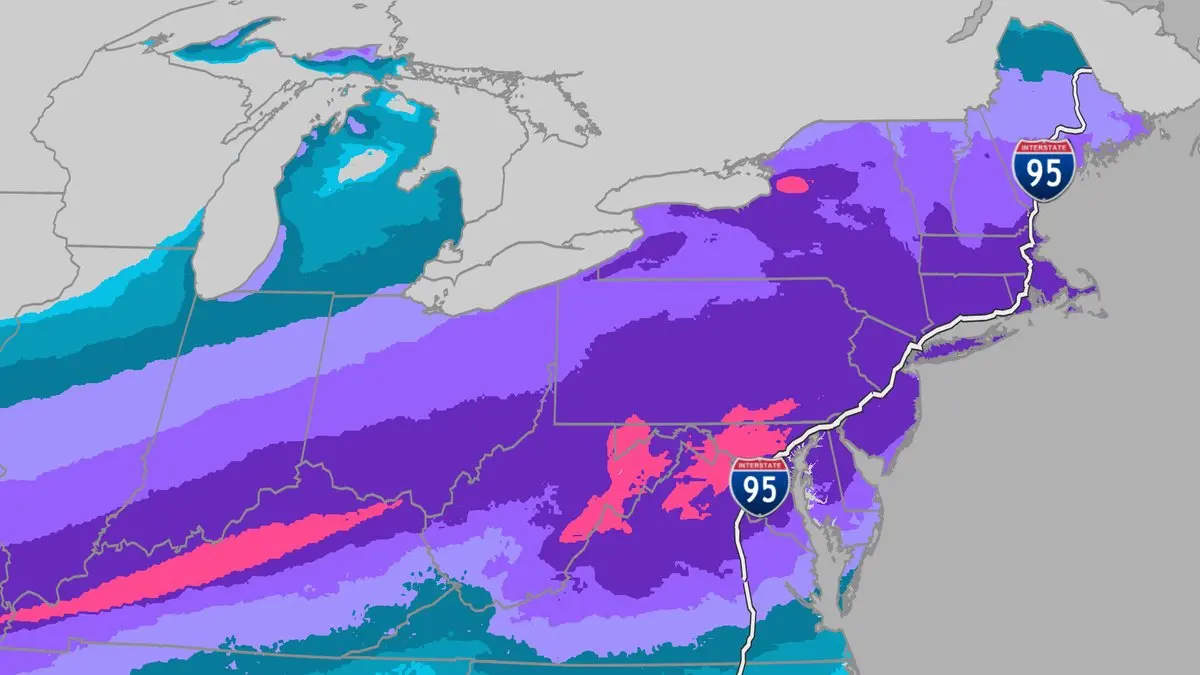

Winter Storm Fern has already caused nearly 2,000 flight cancellations across the U.S., with major disruptions expected through Monday at airports from Dallas and Atlanta to New York and Boston. As thousands of travelers scramble to find solutions, many don't realize they may already have powerful protections sitting in their wallets. The right credit card can provide financial relief, rebooking flexibility, and peace of mind when weather, mechanical issues, or other problems derail your travel plans.

Why Your Credit Card Matters During Flight Cancellations

When airlines cancel flights due to weather or other circumstances, they typically aren't required to compensate passengers beyond rebooking on the next available flight. This leaves travelers covering costs for extended hotel stays, meals, alternative transportation, and other unexpected expenses. Premium travel credit cards offer built-in protections that can save you hundreds or even thousands of dollars during these disruptions.

Trip Cancellation and Interruption Insurance: Your Safety Net

Many premium credit cards include trip cancellation and interruption insurance when you book your travel with the card. Here's what these benefits typically cover:

- Trip Cancellation Insurance reimburses you for prepaid, non-refundable travel expenses if you need to cancel your trip before departure due to covered reasons like illness, injury, severe weather, or jury duty. Coverage limits typically range from $5,000 to $10,000 per trip.

- Trip Interruption Insurance covers you if your trip is cut short or disrupted after you've already departed. This can include reimbursement for unused portions of your trip, additional transportation costs to return home or continue your journey, and accommodation expenses if you're stranded.

Trip Delay Coverage: Help When You're Stuck

Trip delay coverage kicks in when your flight is delayed by a certain number of hours (typically 6-12 hours, depending on the card). This benefit usually reimburses you for:

- Hotel accommodations if an overnight stay becomes necessary

- Meals during the extended delay

- Essential purchases like toiletries or clothing

- Local transportation to and from your hotel

With major hubs in Atlanta, Dallas-Fort Worth, New York, Charlotte, Washington, Philadelphia, and Boston facing potential multi-day disruptions from Winter Storm Fern, this coverage can be invaluable. Some cards offer up to $500 per ticket in trip delay reimbursement.

Best Credit Cards for Flight Cancellation Protection

Premium Travel Cards with Comprehensive Coverage

[[ SINGLE_CARD * {"id": "510", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "High-Value Perks"} ]]

[[ SINGLE_CARD * {"id": "106", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Serious Points on Flights"} ]]

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Eligibility and Benefit level vary by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

[[ SINGLE_CARD * {"id": "509", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Exceptional Travel Value"} ]]

Cards with Strong Rebooking Flexibility

[[ SINGLE_CARD * {"id": "438", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "High Travel Rewards" } ]]

Cards earning transferable rewards (Chase Ultimate Rewards, American Express Membership Rewards, Capital One miles, Citi ThankYou Points) give you the most flexibility because you can transfer rewards to airline partners for award flights if cash fares are expensive during disruptions.

How to Use Your Credit Card Benefits When Flights Are Canceled

Step 1: Document Everything

Take photos of departure boards showing your canceled flight, save all email notifications from the airline, and keep receipts for any expenses you incur. Most credit card travel insurance requires documentation within specific timeframes.

Step 2: Check Airline Rebooking Options First

Airlines typically rebook you on their next available flight at no charge. If the delay is significant, ask about:

- Flights on partner airlines

- Routing through different connecting cities

- Meal vouchers or hotel accommodations (airlines may provide these even when not required)

Step 3: Activate Your Card's Benefits

If airline-provided options won't work or you're facing extended delays:

- Call your credit card's benefits administrator (the phone number is usually on the back of your card or in your online account)

- Explain the situation and ask what coverage applies

- Ask about advance approval for expenses you're about to incur

- Understand the claims process, including deadlines and required documentation

Step 4: Book Alternative Travel if Necessary

If you need to reach your destination urgently and airline rebooking isn't adequate, you may need to book alternative flights. Using the same credit card that has travel insurance is important - most policies only cover trips booked entirely with that card.

Step 5: File Your Claim Promptly

Most card issuers require claims within 20-60 days of the incident. Submit all required documentation, including:

- Proof of original booking (confirmation emails, receipts)

- Proof of cancellation/delay (airline notifications, departure board photos)

- Receipts for covered expenses

- Completed claim forms

What Credit Card Travel Insurance Typically Doesn't Cover

Understanding exclusions is important:

- Known storms: Some policies exclude cancellations for weather events that were already forecasted when you booked

- Voluntary cancellations: You can't simply change your mind

- Work obligations: Most policies don't cover cancellations because you need to be at work

- Third-party bookings: Some cards require you to book directly with airlines or hotels, not through third-party sites

- Points and miles: You can usually only claim reimbursement up to the cash amount you paid

Additional Credit Card Benefits for Travel Disruptions

Baggage Delay Insurance

If your bags are delayed (typically 6+ hours), many cards reimburse you for essential purchases like clothing and toiletries.

Lost Luggage Coverage

Provides compensation if the airline loses your checked bags permanently, supplementing the airline's liability limits.

Travel Accident Insurance

Covers accidental death or dismemberment during common carrier travel, providing additional protection beyond the airline's coverage.

Concierge Services

Premium cards include 24/7 concierge services that can help with:

- Finding and booking alternative flights

- Locating hotel availability during sold-out situations

- Making restaurant reservations in unfamiliar cities

- Arranging ground transportation

Car Rental Coverage

If you rent a car to drive to your destination instead of flying, many cards include collision damage waiver coverage, saving you $15-30 per day in rental counter fees.

Maximizing Your Protection: Pro Tips

Use one card for all travel bookings. Mixing payment methods can create gaps in coverage since most trip insurance only covers portions paid with the specific card.

Pay for your flight with your premium travel card, even if using miles. Most airlines allow you to book award flights and pay taxes and fees with a credit card. Those fees are usually enough to trigger travel insurance benefits.

Check your credit card benefits guide annually. Coverage can change, and you want to know what you have before you need it.

Save your benefits administrator's phone number. Program it into your phone so you can reach them easily during disruptions.

Take advantage of weather waivers. When airlines issue travel waivers for weather events (like Winter Storm Fern), you can often rebook within a specified window without fees - complementing your card's protections.

What to Do Right Now if You're Affected by Flight Cancellations

- Check if you booked with a card that has travel insurance by reviewing your benefits guide online

- Contact the airline for rebooking options before considering alternative arrangements

- Keep all receipts if you incur any expenses due to the delay or cancellation

- Take photos of airport information boards, delay notifications, and any other relevant documentation

- Consider travel flexibility - if your trip isn't urgent, it may be better to wait a few days for the weather to clear rather than navigating complex rebooking

The Bottom Line

Flight cancellations like those caused by Winter Storm Fern are frustrating and potentially expensive, but the right credit card can provide significant financial protection and peace of mind. With more than 2,100 flights already canceled and more disruptions likely through Monday, these benefits could be the difference between a minor inconvenience and a major financial setback.

Key Takeaways:

- Premium cards offer the best protection: Premium cards provide comprehensive coverage with generous limits and faster trigger times (6 hours vs. 12).

- Mid-tier cards provide excellent value: The Chase Sapphire Preferred offers nearly the same trip cancellation coverage as premium cards.

- Document everything immediately: Photos, receipts, and notifications are crucial for successful claims. Start documenting the moment delays begin.

- Act fast on rebooking: During major disruptions, accommodation and alternative flights sell out quickly. Move decisively while staying in contact with your card's benefits team.

- Know before you go: Review your card's benefits guide before traveling so you understand what's covered and how to file claims. Program important phone numbers into your phone now.

- Use one card consistently: Book all trip elements with the same card to avoid coverage gaps.

The investment in a premium travel credit card often pays for itself the first time you need to use its insurance benefits—and that's before considering the rewards, airport lounge access, and other perks these cards provide. With Winter Storm Fern affecting 230 million Americans and causing historic travel disruptions, now is the time to understand and leverage these powerful protections.

Frequently Asked Questions

Does trip delay coverage apply to weather delays?

Yes! Unlike airline compensation rules, credit card trip delay coverage typically applies regardless of the reason for the delay, including weather.

Can I claim expenses if I decide to cancel my trip due to the storm?

This depends on your specific card's policy. Some exclude "known storms" for cancellation coverage. However, if you're already traveling and get delayed, trip delay coverage should apply.

Do I need to book directly with airlines to be covered?

Most premium cards (Chase, Amex, Capital One) cover bookings made through online travel agencies. Always check your specific card's terms.

What if I booked with points but paid taxes with my credit card?

Good news! On most cards, paying any portion of the ticket (including just taxes and fees) is enough to trigger coverage. You'll be reimbursed for related expenses, though not for the points' value.

How long do I have to file a claim?

Typically 30-60 days from the date of the incident. Don't delay. Set a calendar reminder to file your claim within two weeks of returning home.

Will using my credit card benefits affect my credit score or rates?

No! Travel insurance benefits are separate from your credit account and don't impact your credit score, interest rates, or relationship with the card issuer.

Can I use my card's concierge service to help rebook flights?

Yes! Premium cards' concierge services can help find alternative flights, though they typically can't make bookings without your payment information. They're most useful for research and finding options you might miss.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)