Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Annual Fee Calculator: Is Your Premium Credit Card Worth Keeping?

July 1, 2025

Is Your Premium Card Actually Earning Its Keep?

When your credit card annual fee posts to your account, that familiar feeling hits: "Am I actually getting my money's worth?" If you're paying $250, $550, or even $895 for a premium card, that's a question worth answering with real numbers—not gut feelings.

The truth? Nearly 60% of premium cardholders can't accurately calculate whether their benefits exceed their annual fee. That's money left on the table, or worse, fees paid for value you're not receiving.

The Hidden Cost of Premium Cards

Here's what most people don't realize: that $550 annual fee on your card isn't just $550. If you're not maximizing the card's benefits, you could be losing $300-400 in unredeemed credits alone. Meanwhile, you might have a no-annual-fee card collecting dust in your wallet that could serve you better.

📊 The average Kudos user with 2-3 premium cards leaves $624 in benefits unused annually.

Let's fix that. Using our 10-point decision framework, we'll calculate whether your premium credit card truly earns its keep—or if it's time for a change.

The 10-Point Annual Fee Calculator Framework

Think of this as your systematic annual fee calculator—a step-by-step way to evaluate whether you're getting value that exceeds what you're paying.

Point 1: Target Specificity

Who Is This Card Actually For?

Premium cards aren't one-size-fits-all. The Chase Sapphire Reserve® works brilliantly if you're a frequent traveler booking $10,000+ in annual travel. But if you travel twice a year? That annual fee becomes harder to justify.

The Question: Does this card match YOUR spending patterns?

Your Action: List your top 5 spending categories from last year. If they don't align with your card's bonus categories, that's a red flag.

Example:

- ✅ Good fit: You dine out 4x/week + $500/month groceries

- ❌ Poor fit: You spend most on gas/Target = Premium travel card is overkill

[[ SINGLE_CARD * {"id": "510", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Frequent Travelers", "headerHint": "Annual Travel Credit"} ]]

Point 2: Dollar Values

Do You Spend Enough to Break Even?

The Formula: Annual fee ÷ net rewards rate = breakeven spending

Point 3: ROI Calculations

Show Me the Math—Does This Card Profit?

- Step 1: Calculate available credits

- Step 2: Calculate net fee

- Step 3: Calculate rewards earned

But here's the catch: Remove those credits you won't actually use, and suddenly you need $32,500 in combined spending just to break even. This is why the "available" vs "used" distinction matters.

Point 4: CTA Density

Can You Actually Access the Value?

The Question: How many steps between you and value?

Some credits activate automatically, while others require:

- Manual enrollment every quarter

- Shopping at specific merchants

- Booking through proprietary portals

- Remembering to use them by expiration dates

Each barrier reduces the likelihood you'll actually capture the benefit.

Your Action: List every credit your card offers. Mark which ones you've ACTUALLY used in the past 12 months. Anything unused doesn't count toward value.

Point 5: Decision Support

Does This Card Help You Use It Wisely?

The Question: How much mental overhead does this card require?

Premium cards with complex benefits create decision fatigue. Do you need to:

- Remember to book through specific portals?

- Enroll in programs quarterly?

- Track rotating categories?

- Monitor multiple expiration dates?

Cards that work best have:

- Clear, straightforward value propositions

- Automatic credits that post without action

- Consistent bonus categories (no rotation)

Point 6: Comparison Context

What Are Your Alternatives?

The Question: Could a no-fee or lower-fee card deliver 80% of the value?

Point 7: Application Path

Downgrade vs Cancel—What's the Smart Move?

The Question: How do you make a change without hurting your credit?

Canceling impacts:

- ❌ Credit utilization (available credit drops)

- ❌ Average account age (can lower score)

- ❌ Your relationship with the issuer

Downgrading preserves:

- ✅ Credit history length

- ✅ Available credit limit

- ✅ Issuer relationship

- ✅ Account age for credit scoring

Pro tip: Call and ask for a downgrade 30-60 days before your annual fee posts. Most issuers will handle this instantly without a hard inquiry.

Point 8: Trust Building

The True Cost Goes Beyond the Fee

The Question: What's the real cost, including opportunity cost?

That $550 annual fee isn't just $550. When you keep a card you're not maximizing, you're also:

Direct costs:

- 💸 Annual fee you're paying

- 💸 Unused credits expiring (average $300/year)

Opportunity costs:

- 💸 Missing better rewards from alternative cards

- 💸 Mental energy tracking unused benefits

- 💸 Potential welcome bonuses on better-fit cards

Example Calculation:

Current situation:

- Premium card annual fee: $550

- Benefits actually used: $200

- Rewards earned: $350

- Net cost: $0 (break even)

Alternative with no-fee 2% card:

- Annual fee: $0

- Same spending earns: $600 cash back

- Net value: +$600

Opportunity cost: $600 lost by keeping the premium card that barely breaks even.

Point 9: Problem-Solution Bridge

Does This Card Actually Solve YOUR Problem?

The Question: Does the card's design match your spending reality?

Premium cards solve specific problems:

✅ You're a frequent traveler:→ Travel cards with lounge access, travel credits, trip insurance, no foreign transaction fees

✅ You have high dining/grocery spend:→ Cards with 4X-5X earning on food categories

✅ You need flexibility:→ Cards with transferable points to multiple airline/hotel partners

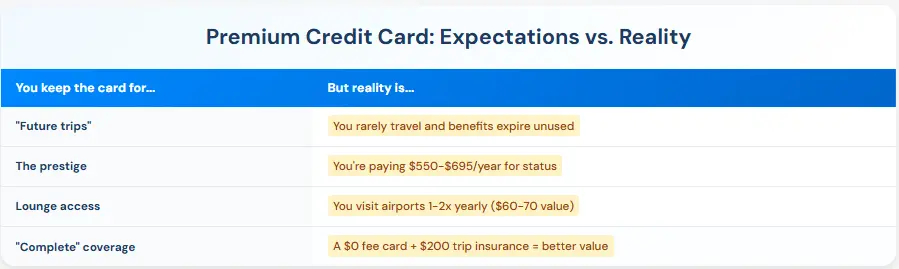

❌ Wrong fit scenarios:

Red flags you're keeping the wrong card:

- You justify the fee with "potential" future use

- You can't name 3 benefits you used last month

- You feel guilty every time the fee posts

- You're hoping "next year will be different"

Point 10: Urgency

Should You Act Now or Wait?

The Question: What happens if you delay this decision?

Before you cancel or downgrade, try this:

Call your card issuer and say: "My annual fee is posting soon. Do you have any retention offers available?"

Common retention offers:

- 10,000-30,000 bonus points (worth $100-$300)

- Partial annual fee waiver ($100-200 off)

- Additional statement credits

- Spending bonuses

But don't wait indefinitely:

If you haven't actively used the card's key benefits in 12 months, a retention offer just delays the inevitable. It's a band-aid, not a solution.

When to act immediately:

- ✋ Annual fee posts in 30 days

- ✋ You haven't used ANY credits this year

- ✋ A better card exists for your spending

- ✋ You're paying for potential, not actual use

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)