Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

What Is the Best Second Credit Card to Get?

July 1, 2025

If you only have one credit card, there are a lot of reasons you should consider getting a second. Many people use the same credit card for years, missing out on rewards and potential credit score benefits.

While there’s no perfect or “right” number of cards to have — Americans have an average of four — it’s less about how many cards you have and more about maximizing your rewards based on spending. The mix of cards you carry can increase benefits and savings.

However, there are some pitfalls of adding a second credit card that you should consider. In this article, we’ll explain why you may need a second credit card and everything you should consider before deciding.

When Should You Get a Second Credit Card?

If you’re like most people, your spending doesn’t fall into just one category, and it can vary each month. For example, sometimes you’ll make more travel purchases, and other times you may make more dining purchases.

If you just have one credit card, you might be leaving money on the table. That is, you’re not optimizing your spending and maximizing your rewards — which you’ll get for spending just as you normally would.

Most people are ready to look for a new credit card after they've had their first one for at least six months. Their credit profile has improved, and they have access to better credit card options.

Major Purchases Coming Up

If you have some big purchases to make, such as home renovations or wedding expenses, you might want a second credit card for several reasons.

The first is that you can take advantage of signup bonuses. Many cards will offer free cash or rewards if you meet a spending goal within the first few months of opening a card. For example, a new card may offer a $250 bonus reward if you spend $2,000 on the card within the first three months.

So if you’re taking a large vacation, then a travel card might be worth looking into. If you’re furnishing or remodeling a home, a cashback card could be advantageous.

New spending habits

Your first credit card was a great introductory card when you were a student or just starting your credit journey; however, now you find that most of your spending is geared toward other spending categories. Say your student credit card offered solid rewards for dining out, but now you don’t visit restaurants as much — your change in spending habits could mean it’s time for a new card.

Looking to maximize rewards

Most people choose to open a second credit card to maximize their rewards or benefits. Two credit cards will likely get you more perks than just one. Many people will look to pair a solid cashback card with a rewards card for the major categories they spend in.

For example, a cashback card could be great for streaming services and transportation. Meanwhile, you can pair it with a card that offers points for entertainment, dining out, and travel purchases.

What To Consider When Getting a Second Credit Card

You’ll want to consider several things before applying for a second credit card; chief among them is the potential credit score impact.

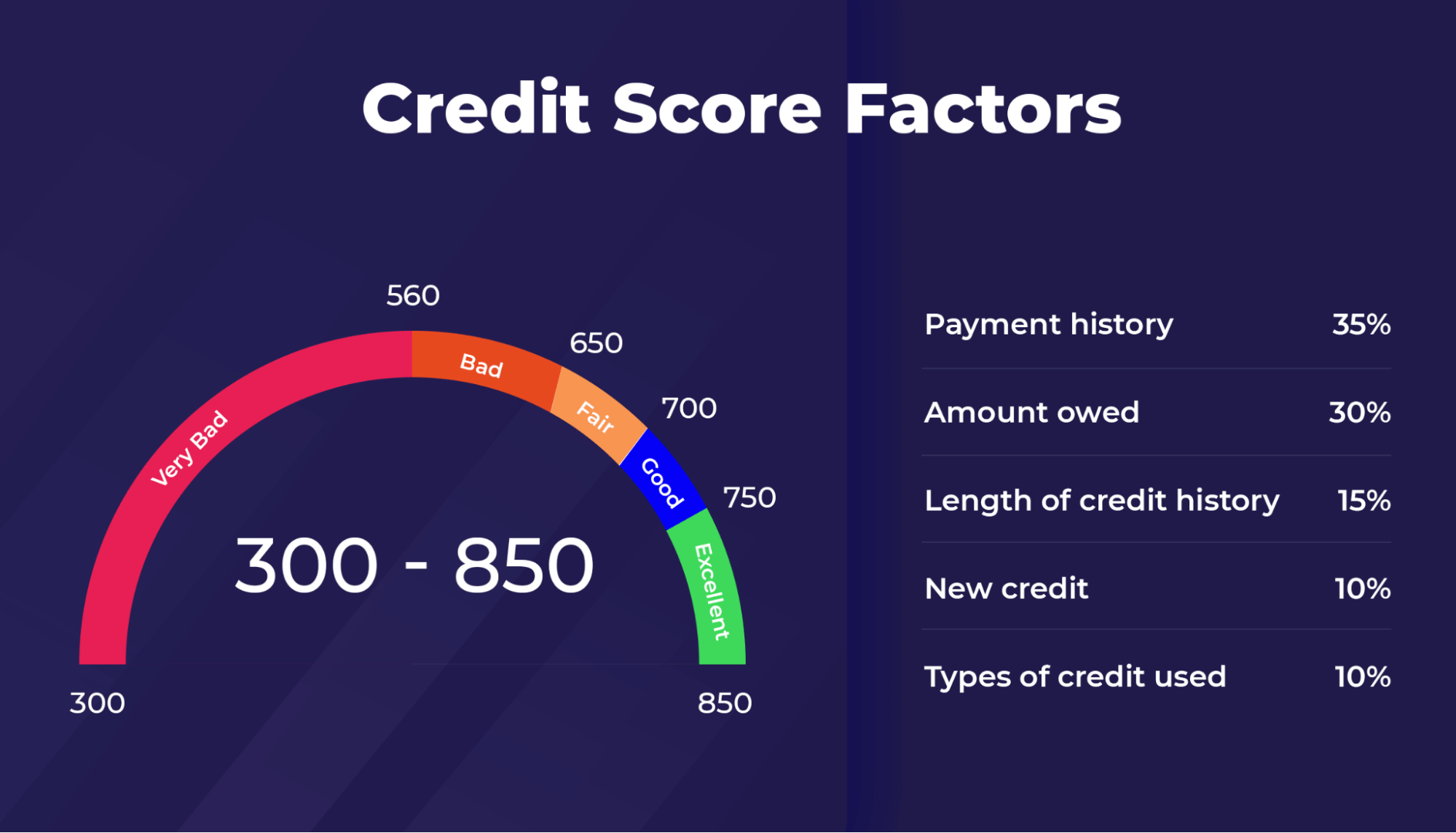

Credit score impact

With a new credit card application comes a new inquiry on your credit report — which makes a temporary ding to your current credit score. However, a second card can boost your credit score over the long term. With a new card will come an increase in your total available credit. This will reduce your utilization ratio, which accounts for 30% of your credit score.

For example, if your initial card has a $1,000 credit limit and you typically have a $500 balance, your credit utilization rate was 50% — which the credit scoring system may consider high (a credit use ratio of 30% or lower is considered good). But then you open a second card, and the spending limit is $2,000 — now your total available credit is $3,000 across all cards. That reduces your credit utilization ratio to less than 17%.

An additional card will also improve your credit mix (the types of accounts you have). Being able to manage different cards and loans improves your credit score.

Rewards diversification

This factor goes together with new spending habits. If you’re growing tired of your current rewards setup, then you might want to diversify your rewards.

Perhaps your current card is an airline card, and with it, you can only redeem rewards toward travel purchases with that airline. So now you need a card that offers additional benefits and rewards spending in other categories, such as groceries or gas purchases.

How To Choose Your Second Credit Card

Your main goals and what you hope to get out of your second credit card will be a major guiding factor when it comes to what you’ll pick. For example, are you looking to maximize your spending with cashback? Or do you want to accumulate rewards points for a big spend — such as a vacation — in the future.

Is there a card you’d eventually like to get, but you know you don’t qualify for it today? Try an entry-level card with that credit card issuer to work your way up. Eventually, you can qualify for the card you want or a product change to it after several months.

Looking to refinance the debt you’re carrying on your first credit card? You’ll also want to consider potential credit card fees and credit score requirements. Here’s how to choose your credit card based on what you’re looking to get out of it.

Rewards

Consider what’s important to you. Are you interested in travel rewards, such as Global Entry or TSA PreCheck? Are you okay with paying an annual fee for premium benefits? Or are you looking for a for everyday purchases, such as a cashback card that offers 1.5% or 2% on each purchase? Certain cashback cards offer higher returns on certain categories, such as 4% on dining or 6% at grocery stores.

Balance transfers

If you’re carrying several thousand dollars on your first credit card that charges 20%+ in interest, you might look to refinance it. That is, make a balance transfer that allows you to move the balance from that card to another credit card with a lower rate.

A balance transfer card will offer a 0% interest rate for a set period — such as 12 or 18 months. With this, you’ll have several months to pay the balance without paying interest.

The big thing is to set a plan to pay the balance off before the period ends. Make sure you don’t run up a large balance on your initial card again. Balance transfer cards offer these introductory rates for a set period, which also makes them useful when making a large purchase that you’ll need some time to pay off.

The interest rate will matter less if you already pay your bills on time and in full each month.

Welcome bonuses

Another thing to consider when looking at second credit card options is sign-up bonuses. Welcome bonuses can be very helpful when you have a major purchase coming up. For example, some cards will offer $250 or more as a sign-up bonus if you spend a certain amount, such as $3,000 in the first three months.

Should You Get More Cards?

Two credit cards are usually better than one. And a third can boost your rewards rates further. When looking to add a card to your wallet, it’s best to diversify a bit so that you can maximize your spending.

If you already have a cashback card, consider a rewards card that capitalizes on the spending you do in your major categories. But the more cards you have, the harder it gets to manage your wallet, and the greater chance of rewards overlap. This can hurt your finances if you’re paying annual fees.

Need a hand managing your credit cards? Kudos sorts through data across 3,000+ cards and millions of online merchants. That means when you’re ready to check out, we’ll scan your wallet to tell you how you should pay and what rewards and benefits you’ll get on that purchase.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)