Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Kudos vs. Monarch: Which App Maximizes Your Money Better? (2026)

July 1, 2025

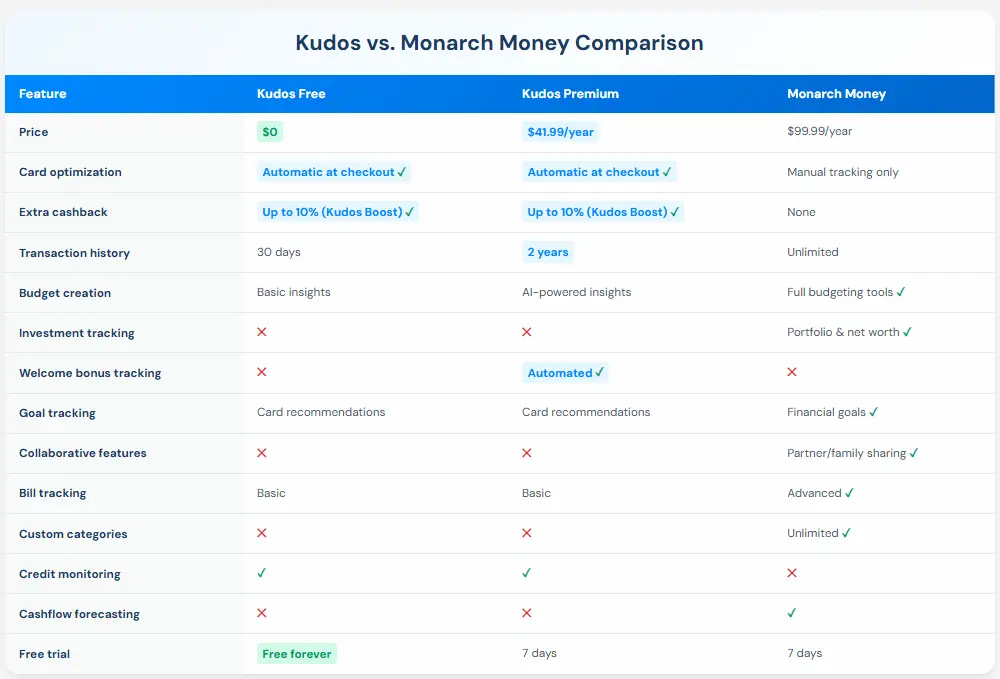

Monarch costs $99.99/year for comprehensive budgeting. Kudos optimizes credit card rewards automatically for free. Want advanced features like advanced AI insights that put your money on autopilot? Kudos Premium costs $41.99/year (58% less). This comparison reveals which app delivers better value for your financial goals.

What Is Monarch?

Monarch Money is a premium budgeting and financial management platform designed to give you a complete picture of your finances. It replaced Mint for many users seeking comprehensive financial tracking with collaborative features.

Key features:

- Comprehensive budget creation and tracking

- Investment portfolio tracking and net worth monitoring

- Custom categories and flexible budget rules

- Collaborative budgeting for partners/families

- Recurring transaction management

- Goal tracking and financial planning tools

- Custom reports and spending insights

- Cashflow forecasting

- Bill tracking and subscription management

Price: $99.99/year or $14.99/month (7-day free trial)

Primary use case: Comprehensive financial management and budgeting

What Is Kudos?

Kudos automatically optimizes your credit card rewards at checkout while tracking your spending. The core app is completely free. Premium ($41.99/year) adds advanced features like 2-year transaction history and automated welcome bonus tracking.

Free (Forever):

- Automatic card recommendations at checkout

- Kudos Boost at over 15,000 partner stores like Sephora, eBay, Etsy, Expedia, and Lowe’s

- Transaction tracking (last 30 days)

- Credit score monitoring

- Autofill & secure payments

- Dream Wallet & Test Drive tools

- Card filtering and exploration

Premium ($41.99/year - optional upgrade):

- Advanced charts & AI spending insights

- 2 years of transaction history that drill into your spending with suggestions to make it smarter

- Automated welcome bonus tracking with alerts

- Coming soon: Auto-activate offers, subscription cancellation, bill negotiation, flight/hotel price monitoring, location-aware recommendations

Price: Free with no restrictions, or $41.99/year for Premium (65% off intro pricing)

Average savings: $1,200/year

Primary use case: Credit card rewards optimization + financial tracking

Head-to-Head Comparison

Why Kudos Wins for Most People

1. Kudos Boost Adds Real Cash Back (Free Feature)

Monarch tracks your spending. Kudos optimizes it and pays you.

Example: $500 Expedia purchase

- Capital One Venture X Rewards Credit Card: 2x points = $10

- Kudos Boost: 8% = $40

- Total: $50 (10% back)

Monarch offers no cashback program. At 15,000+ merchants, Boost consistently adds hundreds of dollars that Monarch can't match. This alone can cover Kudos Premium 12 times over.

[[ SINGLE_CARD * {"id": "2888", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "Frequent Travelers", "headerHint" : "Luxurious Travel Benefits" } ]]

2. Automatic Card Optimization (Both Free and Premium)

Monarch ($99.99/year): Track which cards you use → Manually analyze which was best → Adjust next time

Kudos (Free): Shop normally → Kudos suggests the best card automatically at checkout → Done

Monarch requires you to think about optimization after the purchase. Kudos prevents mistakes before you check out. Over time, this saves hundreds in missed rewards and wrong-card fees.

3. Better Value at Every Price Point

Three options compared:

Kudos Free ($0):

- Optimized rewards: +$400

- Kudos Boost: +$300

- Avoid wrong card fees: +$95

- Total: $795/year

Monarch ($99.99):

- Budget optimization: +$200

- Subscription savings: +$150

- Bill insights: +$100

- Total: $350/year after fee

Kudos Premium ($41.99):

- Everything in Free: +$795

- Welcome bonus saved: +$750 (one-time)

- AI insights: +$150

- Coming soon features: +$670

- Total: $2,323/year after fee

The verdict: Kudos Free delivers 2.3x more value than Monarch while costing nothing. Kudos Premium provides 6.6x more value at 58% less cost

4. Welcome Bonus Tracking (Premium Feature)

Missing a $750 credit card welcome bonus requirement erases Monarch's entire annual value proposition.

Monarch ($99.99/year): No welcome bonus tracking—you need a separate system

Kudos Premium ($41.99/year): Pre-filled offers, automatic tracking, smart alerts before deadlines, customizable for targeted bonuses

One saved welcome bonus covers Kudos Premium for 18 years. Monarch can't help with this at all.

5. No Learning Curve Required

Monarch requires:

- Setting up custom budgets

- Defining categories and rules

- Learning the dashboard

- Regular check-ins to stay on track

- Manual credit card analysis

Kudos requires:

- Install the browser extension

- Connect your cards

- Shop normally

Monarch is powerful but demands commitment. Kudos works automatically from day one, making it easier for busy professionals to optimize without adding another financial chore.

6. Autopilot Features Coming Soon (Premium Feature)

Monarch offers subscription tracking and bill management today. Kudos Premium is launching that plus:

- Auto-activate card offers (Amex, Chase, BoA, Citi)

- Subscription cancellation

- Bill negotiation (keep 100% of savings—no commission)

- Flight/hotel price monitoring & rebooking

- Location-aware recommendations

- Unlimited connected accounts

Monarch helps you understand your money. Kudos actively saves and earns you more.

When Monarch Makes Sense

Monarch is better if you:

- Need comprehensive budgeting: Creating detailed monthly budgets with custom categories and rules

- Track investments: Monitor portfolio performance and net worth across all accounts

- Budget with a partner: Collaborative features for couples/families managing finances together

- Want advanced planning: Cashflow forecasting and long-term financial goal tracking

- Prefer detailed control: Custom categories, flexible rules, and granular expense management

- Don't care about card rewards: Already have a rewards strategy or don't optimize cards

If you're seeking a Mint replacement with robust budgeting tools and don't prioritize credit card optimization, Monarch excels in this space.

Real-World Scenarios

Online Shopper Who Wants Basic Tracking

Annual spending: $20K online, minimal budgeting needs

- Kudos Free: $795/year in optimized rewards + Boost

- Monarch: $350/year in insights after $100 fee

Winner: Kudos (+$445)

Serious Budgeter with Investment Portfolio

Annual spending: $30K, actively manages budget and investments

- Kudos Premium: $2,323/year after $42 fee

- Monarch: $450/year in optimizations after $100 fee

Winner: Kudos Premium (+$1,873)

Note: Monarch provides superior investment tracking, but Kudos' rewards optimization and cashback deliver significantly higher financial returns

Couple Budgeting Together (No Card Optimization)

Annual spending: $50K, collaborative budgeting priorities

- Kudos Premium: $2,323/year after $42 fee (but no collaborative features)

- Monarch: $600/year in savings after $100 fee (with partner features)

Winner: Depends on priorities—Monarch for collaboration, Kudos for total financial return

The Bottom Line

Choose Kudos Free if you:

- Want automatic rewards optimization with zero cost

- Shop primarily online

- Want Kudos Boost cash back (up to 10%)

- Need basic transaction tracking and credit monitoring

- Don't need detailed budgeting or investment tracking

Choose Kudos Premium if you:

- Want everything in Free plus advanced features

- Need automated welcome bonus tracking

- Want 2 years of transaction history and AI insights

- Want upcoming autopilot features at half Monarch's price

- Prefer rewards optimization over detailed budgeting

Choose Monarch if you:

- Need comprehensive monthly budgeting with custom categories

- Track investments and net worth across multiple accounts

- Budget collaboratively with a partner or family

- Want advanced cashflow forecasting and goal planning

- Prefer detailed financial control over rewards optimization

- Already have your card rewards strategy figured out

For most credit card users focused on maximizing financial returns, Kudos delivers significantly better value—especially with Premium features at 58% less than Monarch's price.

FAQ

Is Kudos safe?

Yes. Kudos uses Bank-level 256-bit encryption. Your data is never sold. 400,000+ members trust Kudos.

Does Kudos work with all cards?

Yes. Chase, Amex, Citi, Capital One, Discover, Bank of America, Wells Fargo, and thousands more.

How is Kudos different from Monarch?

Kudos focuses on credit card rewards optimization and automatically suggests your best card at checkout. Monarch is a comprehensive budgeting platform focused on financial planning, investment tracking, and collaborative budgeting. Kudos offers cash back on purchases you’re already making; Monarch doesn't. Kudos Free is $0; Monarch is $99.99/year.

Can I use both?

Yes. Many users combine Monarch's budgeting tools with Kudos' automatic rewards optimization. However, both track transactions, and Kudos offers advanced features that Monarch does not.

What's included in Kudos Premium?

2 years of transaction history, automated welcome bonus tracking with smart alerts, advanced charts & AI insights, and early access to autopilot features (auto-activate offers, subscription management, bill negotiation, flight/hotel monitoring, location-aware recommendations).

How much does Kudos Premium cost?

$41.99/year (65% off intro) or $7.99/month with a 7-day free trial. No automatic charges.

Does Monarch help with credit card rewards?

Not directly. Monarch tracks your spending by card but doesn't recommend which card to use or optimize for rewards. You'd need to manually analyze and decide.

Is Monarch worth $99.99/year?

If you need comprehensive budgeting, investment tracking, and collaborative features for partners/families, Monarch delivers excellent value. If your priority is maximizing credit card rewards and earning cashback, Kudos provides better ROI.

How much can I earn with Kudos?

Average $1,200/year. Active users earn $300-$1,000+ from Boost alone, plus hundreds more from optimized card recommendations and avoiding wrong-card fees.

Does Kudos track investments like Monarch?

No. Kudos focuses on credit card optimization, transaction tracking, and credit monitoring. Though investment portfolio tracking may come in the future, it’s not a feature Kudos provides yet. For investment portfolio tracking and net worth monitoring, Monarch is the winner.

Can I budget with Kudos?

Kudos provides spending insights and transaction history (30 days free, 2 years with Premium), but doesn't offer detailed budgeting tools like custom categories, budget rules, or cashflow forecasting.

Does Kudos auto-charge after the trial?

Never. You must actively choose to continue Premium after your 7-day trial. This is a core principle.

Can I cancel Premium anytime?

Yes. Cancel in the app or web. You keep Premium until your billing period ends, then return to the free tier.

Which is better for someone who left Mint?

Depends on what you valued:

- Budgeting focus: Monarch is the natural Mint successor

- Rewards optimization focus: Kudos delivers better financial returns through credit card optimization + cashback

- Both: Many users run both apps—Monarch for budgeting, Kudos for rewards

Does Monarch have a mobile app?

Yes, for both iOS and Android with full feature parity to the web version.

Does Kudos have a mobile app?

Yes, for iOS. The browser extension works on desktop Chrome, Safari, Edge, and Firefox.

Which is better for beginners?

Kudos. It works automatically at checkout without learning curves or setup. Monarch requires understanding budgeting concepts, setting up categories, and regular maintenance.

Can Monarch save me more money than Kudos?

In theory, strong budgeting discipline could save significant money through reduced spending. In practice, Kudos' automatic rewards optimization and Kudos Boost cashback deliver immediate, measurable returns ($795-$2,323/year) without requiring behavior change. Monarch's value depends entirely on your commitment to budgeting.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)