Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Can You Use Apple Pay to Send Money with a Credit Card? The Hidden Cost Breakdown (2025)

July 1, 2025

Should You Really Use a Credit Card for Apple Pay?

Quick answer: Yes, you can use a credit card to send money through Apple Pay—but it'll cost you 3% per transaction, and your card issuer might treat it as a cash advance with additional fees up to 5% plus immediate interest at 29%+ APR.

The bottom line up front: For most people, using a credit card for Apple Pay person-to-person payments is expensive. If you send $500/month to friends or family, you'll pay $180-$540 in avoidable fees annually. Unless you're earning rewards that exceed these costs or have no other payment method available, you're better off using your debit card, bank account, or alternatives like Zelle (which charges $0).

However, there are specific situations where using a credit card makes financial sense—and we'll show you exactly when that is, how to calculate if it's worth it, and which cards minimize the damage if you must use one.

In this guide, you'll discover:

- The real cost breakdown: 3% Apple fee + potential 5% cash advance fee + interest

- 5 credit cards that treat Apple Pay as a purchase (not cash advance)

- When credit card rewards actually offset the fees

- Free alternatives that save you $540+ annually

- How to avoid cash advance classification completely

Let's break down the numbers so you can make a smarter payment decision.

How Apple Pay Credit Card Payments Actually Work

Apple Pay supports two main types of transactions: contactless payments at stores (which work like normal credit card purchases) and person-to-person payments through Apple Cash in iMessage (which come with special fees).

What Happens When You Send Money via Apple Pay with a Credit Card

When you send money to someone using Apple Pay Cash in the Messages app with a credit card:

Apple's role:

- Charges a flat 3% processing fee on the transaction amount

- Processes the payment instantly

- Requires your credit card to be linked to Apple Wallet

- Limits transactions to $10,000 per transfer and $10,000 weekly

Your card issuer's role:

- May classify the transaction as a "purchase" (standard APR applies)

- May classify it as a "cash advance" (higher fees + immediate interest)

- Determines if you earn rewards on the transaction

- Sets credit utilization based on the amount sent

The Critical Question: Purchase vs. Cash Advance?

This distinction is crucial because it determines your total cost:

Example scenario: Sending $500 to split rent

If treated as purchase:

- Apple fee: $500 × 3% = $15

- Issuer fee: $0

- Total cost: $15 (plus interest if you carry a balance)

- Potential rewards: 1.5% back = $7.50 earned

- Net cost: $7.50

If treated as cash advance:

- Apple fee: $500 × 3% = $15

- Cash advance fee: $500 × 5% = $25

- Interest for 30 days: ($540 × 29% APR) ÷ 12 = $13.05

- Total cost: $53.05

- Rewards earned: $0

The difference: $45.55 for a single $500 transaction.

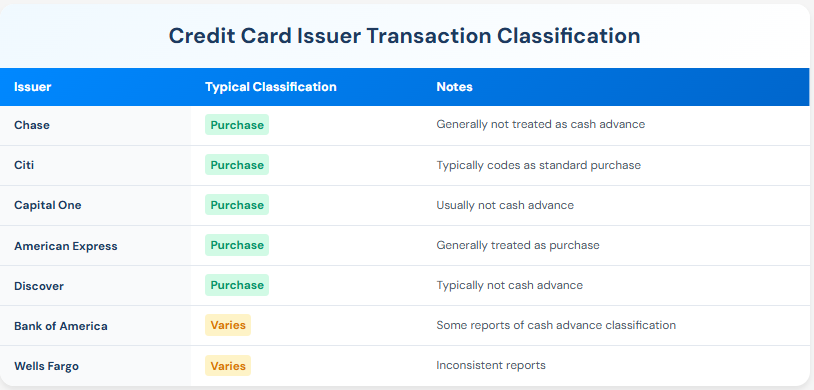

Most major issuers (Chase, Citi, Capital One, American Express) treat Apple Pay person-to-person payments as purchases, not cash advances. However, policies can change, and some regional banks may classify them differently.

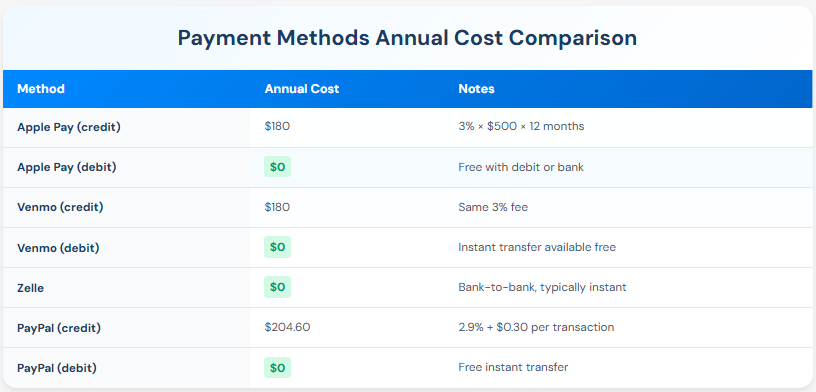

The Real Cost: When Apple Pay Credit Card Fees Add Up

Let's calculate exactly how much using a credit card for Apple Pay costs over time versus free alternatives.

Scenario 1: Regular P2P Payments (Treated as Purchase)

Monthly spending: $500 in Apple Pay transfersFrequency: Splitting bills, sending money to family

Annual cost calculation:

- Apple 3% fee: $500 × 3% × 12 months = $180/year

- Potential rewards offset (1.5% card): $500 × 1.5% × 12 = -$90/year

- Net cost: $90/year

Alternative with Zelle (free):

- Cost: $0

- Savings: $180/year (or $90 after rewards)

Scenario 2: Worst Case - Cash Advance Classification

Same monthly spending: $500If your issuer treats Apple Pay as cash advance:

Annual cost calculation:

- Apple 3% fee: $180/year

- Cash advance fee (5%): $500 × 5% × 12 = $300/year

- Interest charges (29% APR, 30-day payoff): ~$156/year

- Rewards earned: $0

- Total cost: $636/year

Alternative with debit card:

- Cost: $0

- Savings: $636/year

Scenario 3: High-Rewards Card That Justifies the Fee

Card: Hypothetical 4% cash back cardMonthly spending: $500

Break-even analysis:

- Apple fee: $180/year

- Rewards earned: $500 × 4% × 12 = $240/year

- Net gain: $60/year

Verdict: Only worth it if your rewards rate exceeds 3% AND your issuer treats it as a purchase.

Should You Use Credit Card for Apple Pay? Yes if...

✅ Your rewards rate is 3%+ on the transaction

✅ You've confirmed your issuer treats Apple Pay as a purchase (not cash advance)

✅ You pay your balance in full monthly (no interest charges)

✅ You need purchase protection or extended warranty coverage

✅ You're working toward a sign-up bonus and need to hit spending requirements

❌ Skip it if you can use free alternatives (Zelle, bank transfer, debit card)

Step-by-Step: How to Send Money with Apple Pay Using Your Credit Card

If you've decided a credit card is your best option, here's exactly how to do it:

Prerequisites

Before you can send money via Apple Pay with a credit card:

- iOS requirement: iPhone 6 or later, Apple Watch, or iPad with Apple Pay

- Apple Cash setup: Must enable Apple Cash in Wallet app

- Verified identity: Complete identity verification (usually requires last 4 of SSN)

- Credit card linked: Card must be added to Apple Wallet

Step 1: Add Your Credit Card to Apple Wallet

- Open the Wallet app on your iPhone

- Tap the plus (+) icon in the upper right

- Select "Debit or Credit Card"

- Follow prompts to scan your card or enter details manually

- Agree to terms and verify with your bank (usually via text/email code)

Pro tip: Add multiple payment methods so you can choose the most cost-effective option per transaction.

Step 2: Enable Apple Cash

- Open Settings > Wallet & Apple Pay

- Tap Apple Cash > Set Up Apple Cash

- Complete identity verification

- Accept terms and conditions

Step 3: Send Money Through Messages

- Open a conversation in the Messages app with your recipient

- Tap the Apple Pay icon (looks like an "A" logo) in the app drawer

- Enter the amount you want to send

- Tap the payment method indicator to select your credit card (instead of debit/Apple Cash)

- Review the 3% fee displayed

- Tap Pay and authenticate with Face ID, Touch ID, or passcode

Important: The Messages app will show "3% fee" before you confirm. This is your last chance to switch to a free payment method.

Step 4: Alternative Methods

Via Siri (hands-free):

- Say: "Hey Siri, send $50 to [contact name] using Apple Pay"

- Confirm payment method and authenticate

Via Contacts app:

- Open Contacts and select recipient

- Tap Apple Pay button (if available)

- Enter amount and select payment method

- Authenticate and send

Confirmation and Tracking

- Both sender and recipient receive instant message confirmation

- View transaction history: Wallet app > Apple Cash card > Transaction history

- Funds arrive in recipient's Apple Cash instantly (if they have it set up)

- If recipient doesn't have Apple Cash, they'll receive instructions to accept within 7 days

5 Best Credit Cards for Apple Pay Transactions (When You Must Use One)

If you're going to use a credit card for Apple Pay despite the 3% fee, these cards minimize the damage—or in rare cases, turn it into a profit.

1. Citi Double Cash® Card

2. Capital One Quicksilver Cash Rewards Credit Card

3. Chase Freedom Unlimited®

4. Blue Cash Everyday® Card from American Express (See Rates & Fees)

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

5. Discover It Cash Back Credit Card

[[ CARD_LIST * {"ids": ["580", "428", "497", "260", "1098"]} ]]

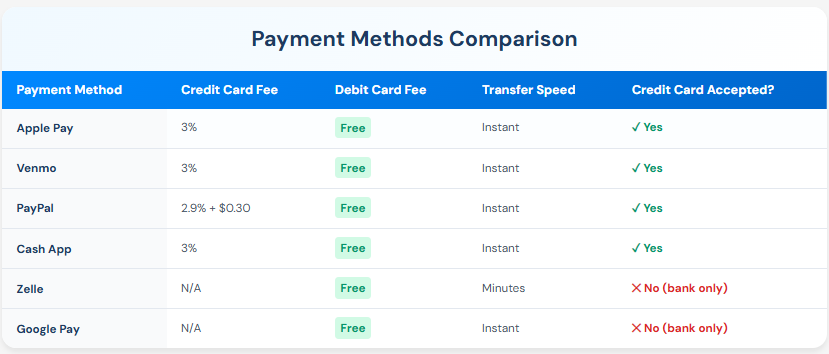

Apple Pay vs. Other P2P Payment Methods: Cost Comparison

Before you commit to using Apple Pay with a credit card, consider these alternatives that might save you hundreds annually.

The Complete P2P Payment Comparison

Key insight: Apple Pay, Venmo, PayPal, and Cash App all charge approximately 3% to use a credit card. Zelle and Google Pay don't accept credit cards at all, forcing you to use free methods.

Cost Comparison: $500 Monthly Transfer

Scenario: You split rent with a roommate and send $500/month

Winner: Zelle saves you $180-$205 annually vs. using any credit card method.

When Each Method Makes Sense

Use Apple Pay with credit card when:

- You need purchase protection on the payment

- You're meeting credit card spending requirements for a bonus

- Rewards exceed the 3% fee (rare)

- You have no other payment method available

Use Apple Pay with debit card when:

- You want instant, free transfers

- Recipient is already in your contacts

- Both parties use iPhones regularly

- You don't need credit card protections

Use Zelle when:

- You want completely free transfers

- Your bank has Zelle built-in (most major banks do)

- Speed matters (typically instant)

- You're sending larger amounts regularly

Use Venmo/Cash App when:

- You want social payment features

- Splitting bills among multiple people

- Using debit card (free)

- Need payment history for tax purposes

How to Verify If Your Card Treats Apple Pay as Cash Advance

Before you send money via Apple Pay with your credit card, you must confirm how your issuer classifies the transaction. Here's how:

Method 1: Check Your Cardholder Agreement

- Log into your credit card account online

- Navigate to "Account Services" or "Documents"

- Download your "Cardholder Agreement" or "Terms & Conditions"

- Search (Ctrl+F) for: "cash advance," "cash equivalent," or "peer-to-peer"

- Look for language about digital wallet transfers or person-to-person payments

Red flags that indicate cash advance:

- "Money transfers through digital wallets are treated as cash advances"

- "Person-to-person payments may be classified as cash equivalents"

- "Peer-to-peer app transfers subject to cash advance fees"

Method 2: Test with a Small Transaction

The safest way to know for certain:

- Send a small amount ($5-$10) via Apple Pay using your credit card

- Wait 24-48 hours for the transaction to post

- Check your credit card statement online

- Look at how the transaction is categorized:

- "Purchase" = Good (treated as regular purchase)

- "Cash Advance" = Bad (incurs higher fees + immediate interest)

Method 3: Call Your Issuer Directly

Most reliable method:

- Call the number on the back of your card

- Ask specifically: "Does your bank treat Apple Pay person-to-person transfers as purchases or cash advances?"

- Request written confirmation via secure message if possible

- Document the representative's name and date of conversation

Major Issuer Policies (As of 2025)

Based on cardholder reports and issuer policies:

Important disclaimer: Issuer policies can change at any time, and individual cards within the same issuer may have different rules. Always verify before making large transactions.

Hidden Costs: What Credit Card Companies Don't Tell You

Beyond Apple's visible 3% fee, there are hidden costs that can make using a credit card for Apple Pay far more expensive than it appears.

Hidden Cost #1: Credit Utilization Impact

Every dollar you send via Apple Pay increases your credit utilization ratio, which accounts for 30% of your credit score.

Example:

- Credit limit: $10,000

- Current balance: $2,000 (20% utilization)

- Send $500 via Apple Pay: New balance $2,500 (25% utilization)

Impact: Utilization above 30% can lower your credit score by 10-30 points temporarily. If you're close to the threshold, P2P payments could push you over.

Solution: Pay off the balance before your statement closes, or use a debit card instead.

Hidden Cost #2: Lost Grace Period (If Cash Advance)

If your issuer treats Apple Pay as a cash advance, you lose your grace period entirely.

Normal purchase: 25-day grace period before interest accruesCash advance: Interest starts accumulating immediately at 29%+ APR

Cost example for $500:

- Interest Day 1: ($500 × 29% APR) ÷ 365 = $0.40/day

- Interest after 30 days: $12

- Total paid if you wait until due date: $512

Hidden Cost #3: Foreign Transaction Fees (International Recipients)

If you send money to someone with an international Apple ID or they receive it abroad, some issuers may charge foreign transaction fees (typically 3%).

Combined cost:

- Apple fee: 3%

- Foreign transaction fee: 3%

- Total: 6% of transaction amount

Hidden Cost #4: No Rewards on Cash Advance

If classified as cash advance, you earn zero rewards—losing 1.5-2% in potential cash back.

Lost value on $500 transaction:

- Standard rewards (2%): $10 you won't earn

- Over 12 months: $120 in lost rewards

Total Hidden Costs: Real Numbers

Worst-case scenario (cash advance + utilization impact + lost rewards):

- Visible Apple fee: $15 (3%)

- Cash advance fee: $25 (5%)

- Interest (30 days): $12

- Lost rewards: $10 (2% you didn't earn)

- Credit score impact: Potentially costs more if seeking new credit

- Total: $62+ on a $500 transaction (12.4% effective fee)

Compare to Zelle: $0 cost, no credit score impact, instant transfer

Strategic Use: When Credit Cards Actually Make Sense for Apple Pay

Despite the fees, there are specific scenarios where using a credit card for Apple Pay is financially smart.

Strategy 1: Meeting Sign-Up Bonus Requirements

Scenario: You have a new credit card requiring $4,000 spend in 3 months to earn a $600 bonus.

The math:

- Spend needed: $4,000

- If $1,000 via Apple Pay: $1,000 × 3% = $30 in fees

- Bonus earned: $600

- Net profit: $570

Verdict: Using Apple Pay to meet spending requirements can be worth the 3% fee if you'd otherwise struggle to hit the threshold.

Strategy 2: Dispute Protection for Questionable Payments

Scenario: You're sending money for a service/product and aren't 100% confident you'll receive it.

Credit card advantages:

- Chargeback rights if merchant doesn't deliver

- Purchase protection up to $500-$10,000 depending on card

- Extended warranty doubling manufacturer coverage

- Return protection if merchant refuses return

Cost-benefit example:

- Sending $500 for concert tickets from private seller

- Apple Pay fee (credit): $15

- Insurance value: Ability to dispute if tickets are fake

- With debit/Zelle: $0 cost, but no recourse if scammed

Verdict: 3% is worth it for large transactions with uncertain sellers.

Strategy 3: Category Bonus Stacking (Rare Edge Cases)

In very specific situations, merchant category coding can make credit cards profitable.

Example:

- Paying a small business owner who codes as "grocery store"

- Card: Amex Blue Cash Preferred (6% at groceries)

- Transaction: $500

The math:

- Apple fee: $15 (3%)

- Rewards earned: $30 (6%)

- Net profit: $15 (3%)

Reality check: This almost never happens. Most Apple Pay P2P transfers code generically, not as bonus categories.

Strategy 4: Float Time for Cash Flow Management

Scenario: You need to send money today but won't have cash until payday in 15 days.

Credit card benefit:

- Send money immediately via Apple Pay (3% fee)

- Pay credit card bill in full when check arrives

- No interest if paid within grace period

Cost: Just the $15 Apple fee on $500 (vs. overdraft fees, late payment penalties, or damaging relationships)

Alternative: Ask to delay payment until payday, but not always possible.

When Strategy Fails: Don't Use Credit Card If...

❌ You can't pay the balance in full before interest accrues

❌ You're already at 30%+ credit utilization

❌ The issuer treats it as cash advance (confirm first!)

❌ You're not earning rewards that offset the 3% fee

❌ A free alternative (Zelle, debit) is available

Frequently Asked Questions

Can I send money through Apple Pay with a credit card?

Yes, you can use a credit card to send money via Apple Pay, but Apple charges a 3% processing fee on all credit card transactions. Debit cards and bank accounts are free.

Does Apple Pay charge a fee for credit cards?

Yes. Apple charges a flat 3% fee when you use a credit card for person-to-person payments through Apple Cash in Messages. There's no fee for debit cards, bank accounts, or Apple Cash balance.

Will using a credit card for Apple Pay count as a cash advance?

It depends on your card issuer. Most major issuers (Chase, Citi, Capital One, American Express) treat Apple Pay person-to-person transfers as regular purchases. However, some banks may classify them as cash advances, which carry higher fees (typically 5%) and immediate interest charges at 29%+ APR. Always verify with your issuer before sending money.

What's the maximum I can send via Apple Pay with a credit card?

After verifying your identity, you can send up to $10,000 per transaction and up to $10,000 within a seven-day period using Apple Pay, whether with credit or debit card.

Do I earn credit card rewards when sending money through Apple Pay?

Usually yes, if the transaction is classified as a purchase. Most major credit cards will earn standard rewards (1-2% cash back) on Apple Pay person-to-person transfers. However, you won't earn rewards if your issuer treats it as a cash advance.

What's cheaper: Apple Pay, Venmo, or PayPal with a credit card?

All three charge approximately 3% for credit card transactions:

- Apple Pay: 3% flat fee

- Venmo: 3% flat fee

- PayPal: 2.9% + $0.30 per transaction

For a $500 transaction, PayPal costs $15.20, while Apple Pay and Venmo cost $15.00. The difference is negligible. Cheapest option: Use Zelle with your bank account ($0 fee).

Can I avoid the 3% Apple Pay credit card fee?

Yes, by using free payment methods:

- Link your debit card to Apple Pay (free)

- Use your Apple Cash balance (free)

- Transfer funds from your bank account (free)

- Use Zelle directly through your bank's app (free, instant)

- Set debit card as default payment method in Wallet settings

Is there a way to send money with credit card protection without paying fees?

Yes, but indirectly. Instead of sending money directly, you could:

- Pay merchants directly with your credit card (no fee, full protection)

- Use Venmo/PayPal for goods and services (credit card fees apply, but you get buyer protection)

- Request invoice from recipient for goods/services (treated as regular purchase, no P2P fee)

Which credit cards treat Apple Pay as a purchase instead of cash advance?

Based on current policies, these issuers typically treat Apple Pay P2P as purchases:

- Chase credit cards

- Citi credit cards

- Capital One credit cards

- American Express cards

- Discover cards

Always verify with your specific issuer, as policies can change.

What happens if I don't have enough credit limit for the Apple Pay transfer?

The transaction will be declined. Apple Pay can only process amounts within your available credit limit. Unlike purchases where you might go slightly over, P2P transfers require sufficient available credit for the full amount plus the 3% fee.

Bottom Line: Is Using a Credit Card for Apple Pay Worth It?

For 95% of people, the answer is no. Using a credit card for Apple Pay costs 3% per transaction ($180/year for $500 monthly transfers), and you'll likely find a free alternative that works just as well.

The math is simple:

- Apple Pay with credit card: $500 transfer = $15 fee

- Zelle/debit card: $500 transfer = $0 fee

- Annual difference: $180+ in avoidable fees

However, there are three specific situations where credit cards make financial sense:

- Meeting sign-up bonus requirements: If you need to spend $4,000 for a $600 bonus, paying $30-$120 in Apple Pay fees is worth it.

- Uncertain transactions needing protection: Large payments to private sellers or questionable merchants justify the 3% cost for chargeback rights.

- Emergency float time: When you must send money today but won't have cash until payday, the 3% fee beats overdraft charges or damaged relationships.

In every other scenario—splitting bills, rent payments, paying family—use free alternatives:

- Zelle (built into most bank apps, instant, $0 fee)

- Apple Pay with debit card ($0 fee)

- Direct bank transfer ($0 fee)

- Venmo/Cash App with debit ($0 fee)

If you must use a credit card for Apple Pay:

- Verify your issuer treats it as a purchase, not cash advance

- Use a 2% cash back card like Citi Double Cash® to reduce net cost to 1%

- Pay the balance immediately to avoid interest charges

- Calculate if rewards truly offset the 3% fee before proceeding

The smartest move? Download Kudos' free browser extension to track all your credit card benefits and rewards. When you need to send money, Kudos can help you determine if using a credit card makes financial sense—or if a free alternative saves you more.

Ready to optimize your payments? Compare the best credit cards for your spending at Kudos Explore Tool and discover which cards maximize rewards while minimizing fees.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)