Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

FutureCard Review 2026: This Debit Card Just Broke the 1% Barrier

July 1, 2025

.avif)

Whereas most traditional debit cards offer zero rewards and even the "best" debit cards cap earnings at a measly 1% on limited spending, the FutureCard Visa® Debit Card has rewritten the rules. As of October 2025, FutureCard now has a two-tier structure: a free tier and a premium tier ($99/year).

We'll dive into the details to help you decide which option is best for you.

What Is the FutureCard Visa Debit?

[[ SINGLE_CARD * {"id": "3465", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "High Reward Seekers", "headerHint": "No Annual Fee"} ]]

The FutureCard Visa® Debit Card is a fee-free debit card (in its standard form) that delivers rewards on everyday purchases—no credit check required. Founded by Future, a financial technology company focused on sustainable spending, the card was designed to reward consumers for purchases they're already making.

As of October 2025, FutureCard operates on two tiers:

Free Tier (No Annual Fee)

✔ 5% cash back on utilities (electric, gas, water)

✔ 5% cash back on public transit (subway, bus, rail)

✔ 10% cash back on EV charging

✔ 1% cash back on everything else (unlimited)

✔ 4.10% APY on your account balance

✔ No annual fee, no credit check, no foreign transaction fees

✔ $5 welcome bonus upon approval

FuturePass Premium ($99/year or $14.99/month)

✔ All free tier benefits (utilities, transit, EV charging)

✔ 5% cash back on groceries (up to $400/month spending = $20 max cashback/month)

✔ 5% cash back on phone bills (up to $100/month spending = $5 max cashback/month)

✔ 5% cash back on streaming services (up to $100/month spending = $5 max cashback/month)

✔ Rotating exclusive offers added regularly

✔ Spend tracking across all connected accounts

✔ Priority customer service access

✔ 30-day free trial for new Premium members

Critical Change: Groceries, phone bills, and streaming services now earn just 1% on the free tier (same as any other purchase) unless there's a temporary promotional offer.

[[ SINGLE_CARD * {"id": "3465", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "High Reward Seekers", "headerHint": "No Annual Fee"} ]]

Breaking Down the Premium Math: Is $99/Year Worth It?

Let's calculate whether FuturePass Premium pays for itself:

Maximum Possible Premium Earnings

Groceries: $20/month × 12 = $240/year

Phone bills: $5/month × 12 = $60/year

Streaming: $5/month × 12 = $60/year

Total maximum premium benefit: $360/year

Minus subscription cost: -$99/year

Net maximum benefit: $261/year

But Here's the Catch

To max out all three categories, you need to spend:

- $400/month on groceries ($4,800/year)

- $100/month on phone bills ($1,200/year)

- $100/month on streaming ($1,200/year)

That's $7,200 annual spending across premium-only categories.

Break-Even Analysis

To break even, you need to earn at least $99 more than the free tier (which gives 1% on these categories).

Scenario: Heavy grocery shopper

- Spend $400/month on groceries = $4,800/year

- Premium tier: 5% = $240

- Free tier: 1% = $48

- Additional benefit: $192

If you only max out groceries, you're $93 ahead after paying the $99 fee. Barely worth it.

Scenario: Max all three categories

- Groceries: $400/month = $192 additional benefit

- Phone: $100/month = $48 additional benefit

- Streaming: $100/month = $48 additional benefit

- Total additional benefit: $288

- Net profit after $99 fee: $189

Verdict: Premium only makes sense if you consistently max out at least two of the three premium categories.

Not sure which card to get? Kudos can help you navigate this process and find the best card offers through CardMatch.

Updated Real ROI Calculations: Free Tier vs. Premium

Scenario 1: Urban Commuter (Free Tier Wins)

Monthly Spending:

- Public transit: $150 ✅ Free tier: 5% = $7.50

- Utilities: $100 ✅ Free tier: 5% = $5

- Groceries: $300 ⚠️ Free: 1% = $3 | Premium: 5% = $15

- Dining: $300 (1% = $3)

- Other: $350 (1% = $3.50)

Free tier annual earnings: $270

Premium tier annual earnings: $414

Net benefit of Premium after $99 fee: $45

Verdict: For $45 extra annually, most urban commuters should skip Premium and stick with the free tier.

Scenario 2: Suburban Family (Premium Could Pay Off)

Monthly Spending:

- Groceries: $400 ⚠️ Free: 1% = $4 | Premium: 5% = $20

- Utilities: $150 ✅ Free tier: 5% = $7.50

- Phone: $100 ⚠️ Free: 1% = $1 | Premium: 5% = $5

- Streaming: $100 ⚠️ Free: 1% = $1 | Premium: 5% = $5

- Other: $500 (1% = $5)

Free tier annual earnings: $294

Premium tier annual earnings: $582

Net benefit of Premium after $99 fee: $189

Verdict: If you consistently max all three premium categories, Premium pays off with $189 extra annually.

Scenario 3: EV Owner (Free Tier Dominates)

Monthly Spending:

- EV charging: $200 ✅ Free tier: 10% = $20

- Utilities: $120 ✅ Free tier: 5% = $6

- Groceries: $250 ⚠️ Free: 1% = $2.50 | Premium: 5% = $12.50

- Other: $400 (1% = $4)

Free tier annual earnings: $390

Premium tier annual earnings: $510

Net benefit of Premium after $99 fee: $21

Verdict: When EV charging already delivers massive free rewards, Premium barely adds value.

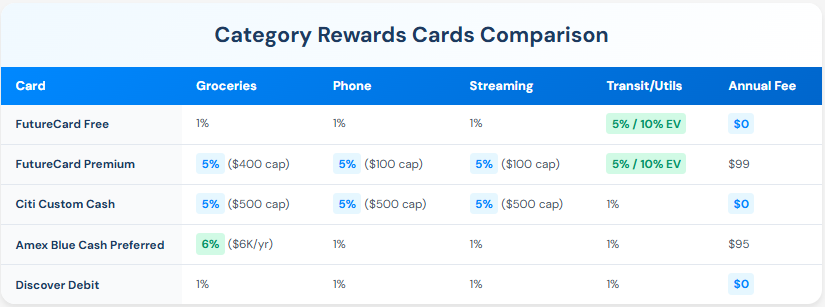

Updated Comparison: Free vs. Premium vs. Credit Cards

Key insight: Citi Custom Cash® Card offers more generous spending caps ($500/month vs. $400/month for groceries) with no annual fee. FutureCard Premium's main advantage is the free tier benefits (transit/utilities/EV) that you keep with Premium.

FutureCard vs. Credit Cards: The Updated Smart Strategy

The two-tier structure changes how you should use FutureCard strategically:

Use FutureCard Free Tier For:

✅ Daily transit (5% vs. 1% on most credit cards)

✅ Utility bills (5% vs. 0-1% elsewhere)

✅ EV charging (10% is unbeatable)

✅ Any spending when avoiding credit

✅ International purchases (no foreign transaction fees)

Consider FutureCard Premium For:

⚠️ Groceries IF you spend $300-400/month consistently AND don't have better credit card options

⚠️ Phone bills IF you spend $100+/month

⚠️ Streaming IF you subscribe to $100+/month in services

Use Credit Cards For:

✅ Building credit history (FutureCard won't help your credit score)

✅ Sign-up bonuses (credit cards offer $200-$1,000 welcome offers)

✅ Better grocery rewards (Amex Blue Cash Preferred: 6%, Citi Custom Cash: 5% with no fee)

✅ Extended warranties and purchase protection

✅ Dining (FutureCard offers 1% on both tiers)

Updated Pro Tip: Keep FutureCard free tier for transit/utilities/EV charging, and use a no-annual-fee card like Citi Custom Cash® Card for groceries (5% on up to $500/month, no annual fee). This combo beats FutureCard Premium.

Should You Apply? Updated Decision Framework

You Should Apply for Free Tier FutureCard If:

✅ You spend $150+ monthly on public transportation

✅ You want 5% back on utility bills with no annual fee

✅ You own an EV and charge regularly (10% is unmatched)

✅ You prefer debit over credit for budget control

✅ You're rebuilding credit or have no credit history

✅ You travel internationally (no foreign transaction fees)

Free tier break-even: If you spend just $150 monthly on transit alone, you'll earn $90 annually at zero cost.

You Should Upgrade to Premium ($99/year) If:

✅ You spend $400+ monthly on groceries consistently

✅ You spend $100+ monthly on phone bills

✅ You spend $100+ monthly on streaming services

✅ You want consolidated spend tracking

✅ You'll max at least 2 of the 3 premium categories monthly

Premium break-even: You need to earn $99+ more than the free tier, which means spending roughly:

- $300+/month on groceries ($144 additional benefit) + $100/month on phone ($48 additional benefit) = $192 benefit - $99 fee = $93 profit

You Should Skip FutureCard Entirely If:

❌ You rarely use transit and have low utility bills

❌ You exclusively use credit cards for points/miles

❌ You need same-day fund access (manual transfers take 1-3 days)

❌ You want rewards on dining (only 1% on both tiers)

What Didn't Change (The Good News)

Despite introducing Premium, these benefits remain free for all users:

✅ 5% on utilities (electric, gas, water)

✅ 5% on public transit (subway, bus, rail)

✅ 10% on EV charging

✅ 1% on everything else (unlimited, no caps)

✅ 4.10% APY on account balance

✅ No annual fee for free tier

✅ No credit check required

✅ No foreign transaction fees

✅ Instant digital card access

For transit-heavy commuters, utility bill payers, and EV owners, the free tier alone justifies having FutureCard.

How to Maximize Your FutureCard Returns (Both Tiers)

For Free Tier Users:

Strategy 1: Focus on guaranteed 5-10% categories

- Route all transit spending through FutureCard (5%)

- Pay all utility bills with FutureCard (5%)

- Use exclusively for EV charging if applicable (10%)

Strategy 2: Leverage the 4.10% APY

- Keep 2-3 months of spending money in your account

- On a $3,000 balance: earn $123 annually in interest

- Combined with rewards: $123 interest + $270 transit/utility rewards = $393 total value

Strategy 3: Pair with category-specific credit cards

- FutureCard for transit/utilities (5%)

- Citi Custom Cash for groceries/dining (5%, no annual fee)

- This combo earns more than FutureCard Premium at zero annual cost

For Premium Users:

Strategy 1: Max all three premium categories

- Buy groceries in bulk to hit $400/month consistently

- Consolidate family phone plans to reach $100/month

- Stack streaming services to $100/month

- Goal: Extract full $360 annual premium benefit

Strategy 2: Monitor rotating exclusive offers

- Premium members get access to limited-time bonus offers

- Stack these with base 5% earning rates

- Example: 5% base + promotional $5 bonus = elevated return

Strategy 3: Use spend tracking

- Premium includes cross-account spend tracking

- Use this to optimize which card to use for each purchase

- Identify opportunities to shift spending into premium categories

Updated Limitations You Should Know

The premium tier introduction adds new considerations:

Free Tier Limitations:

⚠️ Groceries now earn 1% (down from 5% before Premium launched)

⚠️ Phone bills now earn 1% (previously 5% during promotions)

⚠️ Streaming now earns 1% (previously 5% during promotions)

⚠️ Manual fund transfers still required (1-3 day processing)

⚠️ Won't build credit (debit card, doesn't report to bureaus)

Premium Tier Limitations:

⚠️ Restrictive spending caps:

- Groceries: Only first $400/month earns 5% ($20 max cashback)

- Phone: Only first $100/month earns 5% ($5 max cashback)

- Streaming: Only first $100/month earns 5% ($5 max cashback)

⚠️ Break-even requires high spending: Need to max 2+ categories monthly to justify $99 annual fee

⚠️ Better alternatives exist: Citi Custom Cash offers 5% on groceries with $500/month cap and $0 annual fee

⚠️ Uncertain future: Some users worry free tier benefits (utilities, transit) could eventually move behind paywall

Updated FAQ

What's the difference between FutureCard Free and Premium?

Free tier includes 5% on utilities/transit, 10% on EV charging, and 1% on everything else with no annual fee. Premium ($99/year) adds 5% on groceries (up to $400/month), phone bills (up to $100/month), and streaming (up to $100/month), plus spend tracking and priority support.

Does FutureCard still offer 5% on groceries?

Only with FuturePass Premium ($99/year). The free tier earns 1% on groceries unless there's a temporary promotional offer. Premium members earn 5% on up to $400/month in groceries ($20 max cashback/month).

Is FutureCard Premium worth $99/year?

Only if you consistently spend $300+/month on groceries AND $100/month on phone bills or streaming. To break even, you need to earn $99 more than the free tier. Most users are better off using the free tier plus a $0 annual fee credit card like Citi Custom Cash for groceries.

Can I try Premium before committing?

Yes, FutureCard offers a 30-day free trial of FuturePass Premium. You can cancel anytime before the trial ends to avoid the $99 annual charge.

What happens if I cancel Premium?

You'll revert to the free tier and lose access to 5% on groceries, phone bills, and streaming. You'll keep all free tier benefits (5% utilities/transit, 10% EV charging, 1% everything else).

Will free tier benefits move to Premium eventually?

Unknown. As of October 2025, FutureCard states the free tier will "continue to be America's most rewarding debit card" with 5% on utilities and transit remaining free. However, the Reddit community has expressed concern about potential future changes.

Are there spending caps on Premium categories?

Yes, strict monthly caps:

- Groceries: 5% on first $400/month only

- Phone bills: 5% on first $100/month only

- Streaming: 5% on first $100/month only

After hitting these caps, you earn 1% on additional spending in these categories.

Can I have FutureCard without Premium?

Yes! The free tier has no annual fee and includes excellent benefits: 5% on utilities and transit, 10% on EV charging, 1% on everything else, and 4.10% APY.

Bottom Line: Free Tier Still Delivers, Premium Is Questionable

The free tier remains excellent for transit commuters, utility bill payers, and EV owners. These categories alone justify having FutureCard at zero annual cost.

FutureCard Premium is harder to recommend. At $99/year with restrictive spending caps, most users would do better with:

- Citi Custom Cash (5% on top category, $500/month cap, $0 annual fee)

- Blue Cash Preferred® Card from American Express (See Rates & Fees) (6% on groceries, $6,000/year cap, $0 for the first year then $95 annual fee but higher earning rates, Cash back is received in the form of rewards dollars or at Amazon check out)

- Free tier FutureCard + any 2% card for non-transit spending

Apply for Free Tier FutureCard Today If:

✅ You spend $150+ monthly on transit or utilities

✅ You own an EV

✅ You want 4.10% APY on your balance

✅ You prefer debit over credit

✅ You have limited/no credit history

Consider Premium Only If:

⚠️ You'll consistently max groceries ($400/month) + phone ($100/month)

⚠️ You don't have better credit card alternatives

⚠️ You want spend tracking across all accounts

The math doesn't lie: The free tier delivers $200-$400 in annual value at zero cost. Premium requires perfect spending alignment to justify the $99 fee—and even then, better no-fee options exist.

Start with the free tier, and only consider Premium after using FutureCard for 2-3 months to see if your spending patterns align with those restrictive caps.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)