Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

OnePay CashRewards Card Review: Is This Walmart Credit Card Worth It in 2026?

July 1, 2025

.avif)

Walmart's new OnePay CashRewards World Mastercard® promises up to 5% cash back for Walmart shoppers. But here's what most reviews won't tell you: you'll need to spend at least $163/month at Walmart just to break even on the Walmart+ membership required for that 5% rate.

Is this card actually worth it, or are you better off with one of the many alternatives? Let's break down the math so you can make the right decision for your wallet.

OnePay CashRewards Card: Quick Facts

Best for: Dedicated Walmart shoppers spending $500+/month

The OnePay CashRewards Card relaunched Walmart's credit card program in partnership with Synchrony Bank. Here's what you need to know:

Key Features:

- No annual fee for the card itself

- Up to 5% cash back at Walmart (Walmart+ members only)

- 3% cash back at Walmart for non-members

- 1.5% cash back everywhere else

- $35 welcome bonus after spending $75 within 30 days

- Issued by Synchrony Bank on Mastercard network

[[ SINGLE_CARD * {"id": "20378", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Walmart Shoppers", "headerHint": "3% at Walmart"} ]]

How the OnePay Rewards Really Work

Understanding the tiered structure is critical before applying:

For Walmart+ Members ($98/year or $12.95/month)

- 5% unlimited cash back on all Walmart purchases (in-store and online)

- 1.5% cash back everywhere else Mastercard is accepted

For Non-Members

- 3% unlimited cash back on Walmart purchases

- 1.5% cash back on all other purchases

Real Dollar Example:

Scenario: You spend $500/month at Walmart

- With Walmart+: $25/month cash back = $300/year

- Without Walmart+: $15/month cash back = $180/year

- Difference: $120/year (but Walmart+ costs $98)

- Net benefit: $22/year for paying for Walmart+

Rewards are earned as OnePay Points (1 cent each) and redeemed as statement credits or deposits into OnePay Cash accounts.

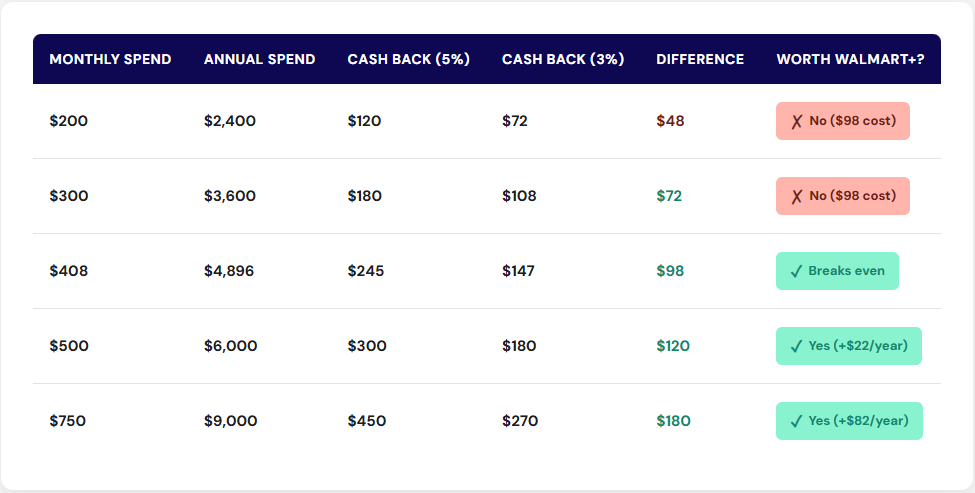

The Walmart+ Math: Should You Pay for the Membership?

Here's the critical break-even analysis most reviews skip:

To justify the $98 Walmart+ membership through card rewards alone:

- Extra 2% cash back on Walmart purchases (5% vs 3%)

- Need to earn $98 ÷ 2% = $4,900 in annual Walmart spending

- That's $408/month minimum at Walmart

Monthly Walmart Spending Break-Even Chart:

Bottom line: Unless you spend $408+/month at Walmart, you're better off as a non-member earning 3% back.

Pros and Cons: The Complete Picture

Pros ✅

- High Walmart rewards rate (5% for members, 3% for non-members)

- No annual fee on the card keeps base costs low

- Solid catch-all rate at 1.5% beats most store cards

- Easy approval with prequalification available

- Real cash back (not store credit or restricted points)

- $35 welcome bonus is easy to earn ($75 spend in 30 days)

- Works everywhere Mastercard is accepted

Cons ❌

- Requires $408/month Walmart spending to justify Walmart+ membership

- Limited bonus categories outside Walmart (just 1.5%)

- Modest welcome bonus compared to premium cards ($35 vs $200-500)

- Customer service concerns reported by users (Synchrony Bank issues)

- Account security complaints in user forums

- Better alternatives exist for diversified spending

How to Apply & What to Expect

Application Process:

- Prequalify first (soft pull, no credit score impact)

- Submit full application if prequalified

- Credit decision typically within minutes

- Receive card within 7-10 business days

- Activate online or via phone

Credit Requirements:

- Fair to Good credit (580-700+) typically needed

- Income verification may be required

- If declined for OnePay CashRewards, you may be offered OnePay Walmart Spend Card (store-only, no cash back)

What You'll Need:

- Social Security number

- Annual income

- Current address and housing payment

- Valid photo ID

Pro tip: Applying with a higher stated income (within honest limits) can improve approval odds.

Should You Apply? Decision Framework

✅ Yes, Apply If:

- You spend $500+/month at Walmart consistently

- You're already a Walmart+ member (or value its other perks)

- You want a simple rewards structure focused on one retailer

- Your credit score is fair to good (580+)

- You do 80%+ of your shopping at Walmart

- You want a no-annual-fee card for Walmart purchases

Expected annual value: $120-300+ depending on spending

❌ No, Look Elsewhere If:

- You spend under $400/month at Walmart

- You don't want to pay for Walmart+

- You shop at multiple retailers regularly

- You want travel rewards or transferable points

- You prioritize premium customer service

- You value large welcome bonuses ($200+)

- You want broader bonus categories (gas, dining, groceries)

Better alternatives below could earn you $200-600 more annually.

Best Alternatives: Smart Walmart Shoppers Consider These Instead

Limit card mentions to 5 maximum, focusing on the most strategic alternatives:

1. Blue Cash Preferred® Card from American Express (See Rates & Fees)

[[ SINGLE_CARD * {"id": "261", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Cash Back Seekers", "headerHint": "Popular Cash Back Card"} ]]

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

2. Citi Double Cash® Card (See Rates & Fees) - Best Simple Alternative

[[ SINGLE_CARD * {"id": "580", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Everyday Spenders", "headerHint": "No Annual Fee"} ]]

3. Chase Freedom Flex® - Best for Flexible Spending

[[ SINGLE_CARD * {"id": "2883", "isExpanded": "true", "bestForCategoryId": "52", "bestForText": "No-Annual Fee Card Seekers", "headerHint" : "No Annual Fee" } ]]

4. Capital One SavorOne Rewards Credit Card - Best for Lifestyle Spending

[[ SINGLE_CARD * {"id": "18233", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Everyday Spenders", "headerHint": "8% at Capital One Entertainment Portal"} ]]

Real User Experiences: What Walmart Shoppers Say

Based on Reddit discussions and user reviews, here's the unfiltered truth:

Positive Feedback 👍

- "Easy QR code payments at checkout" - seamless integration

- "Instant cash back rewards show up immediately"

- "Simple redemption, no hoops to jump through"

- "Good for budget-conscious families who live at Walmart"

- "Approval was quick, got it with a 640 credit score"

Concerns & Complaints 👎

- "Customer service is terrible - typical Synchrony Bank issues"

- "Account was locked twice for 'suspicious activity' when it was just normal Walmart shopping"

- "App crashes frequently, hard to track rewards"

- "Dispute resolution took 3 months for a simple issue"

- "Not worth the hassle unless you're literally at Walmart weekly"

Expert Take:

The OnePay card works as advertised for rewards earning, but Synchrony Bank's reputation for customer service and security issues is a legitimate concern. If you value peace of mind and responsive support, the alternatives above offer better overall experiences.

FAQ: OnePay CashRewards Card

Is the OnePay CashRewards Card worth it?

It's worth it only if you spend $500+/month at Walmart and either already have Walmart+ or spend $408+/month to justify the membership. For most shoppers, better alternatives exist (see above).

What credit score do you need for the OnePay Walmart card?

Fair to Good credit (typically 580-700+) is usually required. You can prequalify with no credit score impact to check your approval odds.

Do I need Walmart+ to get 5% cash back?

Yes. Without Walmart+ ($98/year or $12.95/month), you only earn 3% back at Walmart. You need to spend $408+/month at Walmart for the membership to pay for itself through the extra 2% cash back.

Can I use the OnePay CashRewards Card anywhere?

Yes, it's a Mastercard that works everywhere Mastercard is accepted. You earn 1.5% on non-Walmart purchases.

How long does it take to get approved?

Most applicants receive instant credit decisions. The physical card arrives within 7-10 business days.

What's the welcome bonus?

Earn $35 after spending $75 within 30 days of account opening - one of the smallest welcome bonuses among major credit cards.

How do I redeem my rewards?

Redeem OnePay Points (worth 1 cent each) as statement credits or deposits into a OnePay Cash account. Minimum 25 points ($0.25) required to redeem.

Can I combine OnePay with other Walmart discount programs?

Yes, OnePay rewards stack with Walmart promotions, coupons, and rollbacks. Use the card for everything to maximize your 3-5% back.

Bottom Line: Is the OnePay Walmart Card Right for You?

The OnePay CashRewards Card delivers on its promise of high Walmart cash back (3-5%), but it's a specialized tool, not a one-size-fits-all solution.

You should apply if:

You're a Walmart loyalist spending $500+/month there, you're already a Walmart+ member (or willing to become one), and you want a simple no-annual-fee card focused on one retailer. Expected value: $120-300/year.

You should skip it if:

Your Walmart spending is under $400/month, you shop at diverse retailers, or you value premium customer service. The alternatives above could net you $200-600 more annually with better welcome bonuses, broader categories, and superior support.

Smart strategy:

Use OnePay for Walmart purchases only, pair it with a 2% everywhere card (like Citi Double Cash) for non-Walmart spending, and maximize rotating category cards when Walmart is featured. This multi-card approach can yield $500+ annually in rewards.

Bottom line: The OnePay CashRewards Card is good at one thing - Walmart spending. If that matches your life, apply. If not, you have better options.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)