Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Using a Credit Card for Emergencies

July 1, 2025

Whether it’s an unexpected car repair, a hefty medical bill, or a natural disaster, emergencies can strike at any time and easily derail your personal finances. To prepare for the unexpected, it’s always wise to have a plan.

You might be considering using a credit card for emergencies. But is this a good idea? This guide will explore the pros and cons of this approach while also providing recommendations for the best credit cards for emergencies.

Using a Credit Card for Emergencies

Emergencies large and small can strike at any time, and most Americans aren’t comfortably able to cover expenses via savings. In fact, recent data shows that 56% of Americans wouldn’t be able to cover a $1,000 emergency expense with their savings, and only 42% are comfortable with their emergency savings pot.

If more than half of the country isn’t prepared for a financial emergency, what are people relying on? As it turns out, many Americans are relying on credit cards for emergencies.

Around 70% of Americans have a credit card, and the median credit card limit is $5,394. That’s more than enough to cover most unexpected emergencies.

Credit cards provide a flexible option for funding unexpected expenses. Once you have a card open, you have access to that credit limit at any time — and you don’t have to use it if you don’t need to.

This is the main advantage of credit cards compared to traditional loans. Credit cards are always in your pocket, ready to be used whenever the need arises. You don’t have to wait for loan paperwork to go through, and you can spend any amount up to the credit limit as needed.

Credit cards are also flexible in how you repay, as you can opt to make just the minimum payment or pay off the debt more aggressively.

Of course, credit cards come with drawbacks. The primary downside is their high interest rates. Average credit card APRs are around 20%, making credit cards one of the most costly forms of debt.

Advantages

Credit cards are a versatile and flexible option for paying for emergencies. Here are some of the main advantages.

Flexible spending limits: When you open a credit card, you will be given a maximum credit limit — $5,000, for example. This means you can spend up to $5,000 on that card, borrowing and repaying as needed — including dealing with emergency expenses as they arise.

Ease of access: Around 70% of American adults already have a credit card; this allows them to quickly and easily access emergency funding.

Accepted almost everywhere: Credit cards are accepted for most expenses, from an emergency car repair to an unexpected medical expense. The only expenses that aren’t typically payable via credit card are large installments, like rent and mortgage payments.

Disadvantages

Of course, credit cards aren’t without their drawbacks. Most importantly, they have high interest rates and a high potential to create costly debt.

Creates debt: Credit cards allow you to spend borrowed money. While this is helpful in a pinch, it creates debt that can hamper your finances long-term.

Interest charges increase costs: Credit cards charge high interest rates — often 20% or more. Interest can dramatically increase your long-term costs.

Can add financial stress: Financial emergencies are stressful enough. While credit cards might alleviate the resulting stress temporarily, they can add significant strain due to costly debt.

Credit cards can also have a negative impact on your credit score, particularly if you carry a large amount of debt over a long period of time.

Credit Card Cash Advances for Emergencies

Credit cards can be used to pay service providers or purchase goods in an emergency. But what about expenses like rent, which can’t typically be paid for via credit cards?

There’s another option you can use to access funds using a credit card. It’s called a cash advance, and it allows you to borrow money directly against your credit limit.

With a cash advance, you can get actual cash (via an ATM), or you can request a check or a direct deposit to your bank account. Either way, you’re simply borrowing money that will be added to your credit card debt.

Keep in mind that cash advances have higher interest rates than standard credit card purchases. There may also be other fees associated with cash advances.

Overall, using a cash advance is a costly way to cover emergencies — but it’s another option to consider in some circumstances.

Best Credit Cards for Emergencies

Looking for the best credit card to use? Check out Kudos, the free tool that helps you select the perfect card for your financial situation.

Chances are you already have a credit card — but is it the best emergency card? There are various types of credit cards, but the best credit card for emergencies will typically be one that meets two metrics:

- Has a reasonable interest rate

- Has a high enough credit limit to accommodate a typical emergency

Let’s break these factors down individually.

Interest rates

Credit card interest rates are measured in annual percentage rate, or APR. APR refers to the amount of interest that would accrue on a purchase in one year.

Credit card APRs can range from around 15% to 36% or more. The average is around 21%. The lower the APR, the less you will pay in interest over time.

The APR you receive will vary based on your credit score and income level. If you already have a credit card, you can check your current APR on your monthly credit card statement. If you’re applying for credit, you will be offered a specific APR if you are approved for a loan.

A lower APR is always better, especially if you plan to pay off the debt over time. If you have multiple credit cards, opt for using the one with the lowest APR in an emergency. It’s also wise to compare your credit card APR to rates available from personal loans and other funding options.

Credit limits

A credit limit is the maximum amount of money you can spend on a credit card. If you are given a $4,000 credit limit, you can put up to $4,000 of charges on the account. Once you’ve reached this amount, you max out the limit.

As you make payments, your credit limit will adjust accordingly. If you’ve maxed out your $4,000 limit and make a $500 payment, your credit card balance will drop to $3,500 — leaving you with $500 of remaining credit.

The credit limit you receive will be based on your credit score and income level. The higher your income, the higher the limit credit card issuers will extend to you.

Credit cards with high limits are most useful in emergencies. It’s wise to know your credit limit ahead of time so that you know how much you can spend in an emergency situation. It may even be worth requesting a credit limit increase from your bank, particularly if your credit score or income has improved recently.

If you’re just getting started with credit, browse our guide to credit cards for young adults.

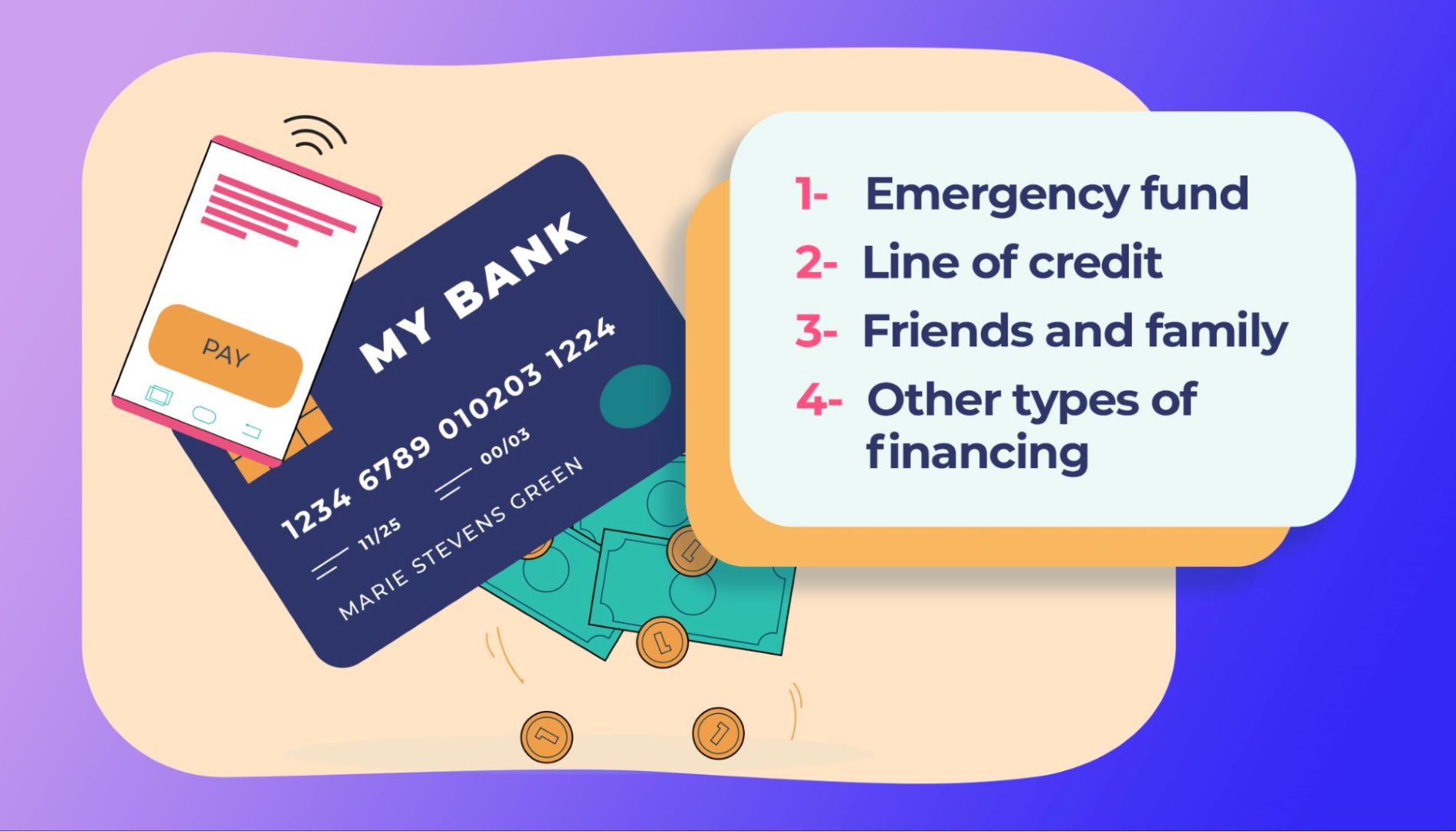

Alternatives to Using a Credit Card

Credit cards can fill the gap in a pinch — but there are worthwhile alternatives to consider.

Emergency fund

An emergency fund is the gold standard of financial emergency preparedness. Essentially, this fund is a chunk of money set aside specifically for emergencies.

Most experts recommend having 3 to 6 months’ worth of living expenses set aside in an emergency fund. While this is a good goal to aim for, it may not be possible for many households. Ultimately, though, any emergency fund is better than none!

Emergency funds should be kept in liquid savings. This means that the money should be easily accessible at any time. Keeping funds in a checking or savings account is suitable, and it may even be wise to keep a small amount of physical cash somewhere safe.

It’s not typically a good idea to invest these funds. If the stock market were to crash, you might be forced to sell at a loss.

Line of credit

A line of credit is similar to a credit card in that you can spend flexibly as needed. You will be given a maximum credit limit, and you can spend freely up to that limit.

Lines of credit are offered by most banks and credit unions. Some are secured — meaning that they are backed by an asset like your home — while others are unsecured.

If you own your home, opening a home equity line of credit (HELOC) might be wise. HELOCs offer attractive interest rates and can be used for both planned expenses and emergencies.

Friends and family

In some cases, friends or family might be able to help out if you’re struggling.

However, it’s important to discuss plans with these individuals before an emergency strikes. For instance, you might wish to ask your parents if you could borrow money from them in the future, should the need arise.

By making a plan ahead of time, you can rest assured knowing that you can count on these resources.

Other types of financing

Other types of financing may be an option, depending on your situation.

Personal or payday loans are viable options, but it’s important to compare the APRs to those offered by credit cards.

Additionally, many retailers offer their own financing options. If your refrigerator goes out, for instance, you may be able to finance the purchase via the retailer’s program.

Just be sure to read the fine print — some of these financing options don’t offer the best terms.

Bottom Line

Ultimately, using a credit card for emergencies can be risky — but sometimes, it might be your only viable option. If you do take on credit card debt, do your best to have a plan to pay it off in a reasonable amount of time. And before you reach for that credit card, make sure you’ve exhausted your alternatives first.

If you’re wondering what the best credit card for emergencies is, check out Kudos. Kudos is a free tool that helps you select the right card to use when purchasing while maximizing rewards and credit card-related perks.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)